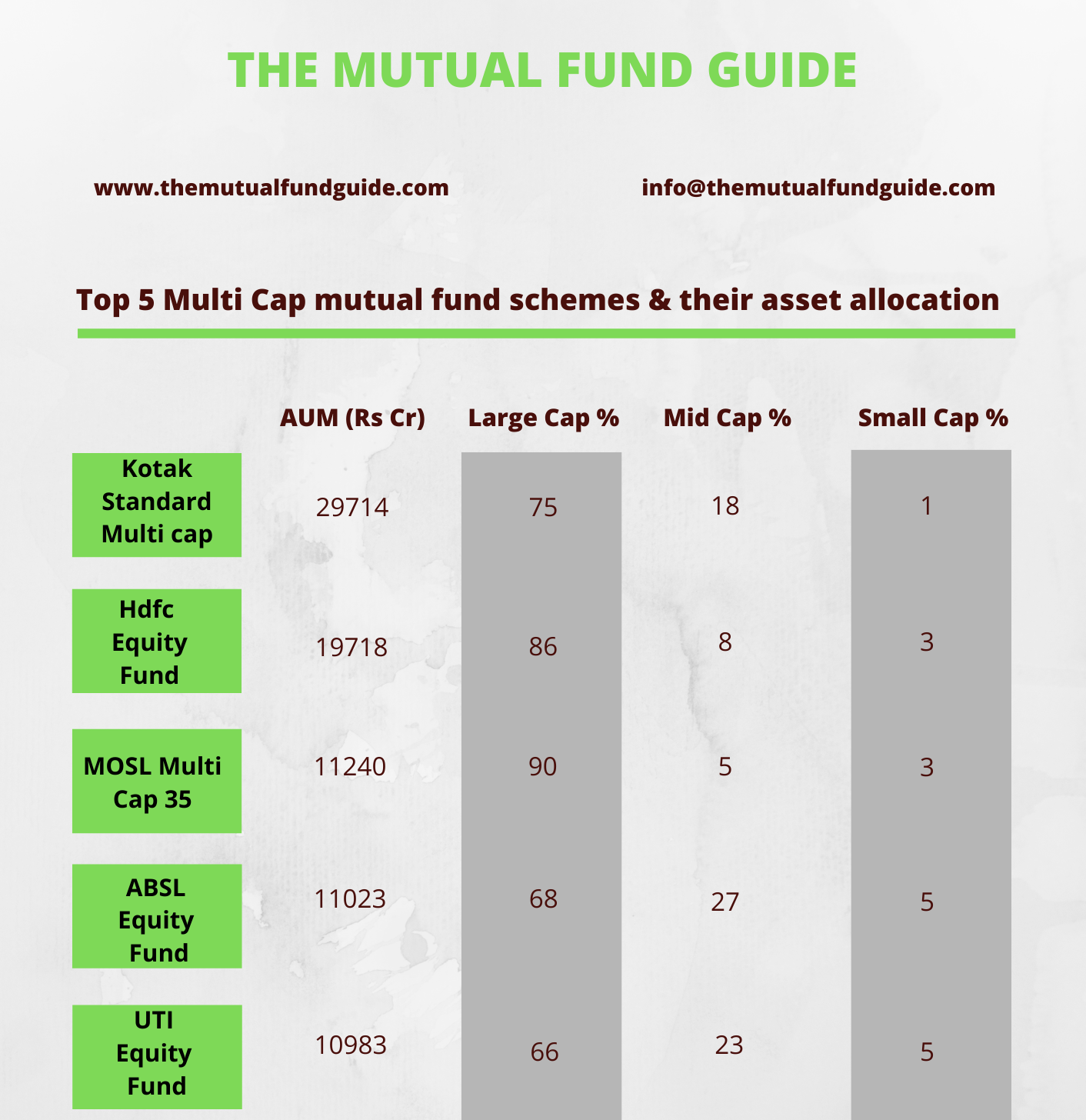

Kotak standard multicap fund is the largest multicap fund in terms of AUM.

This multicap fund from Kotak mutual fund was previously

known as Kotak Select Focus Fund, it being renamed as Kotak standard multicap

fund and recategorized as a multicap fund due to SEBI’s recategorization

exercise in 2018.

|

Fund |

Kotak

Standard Multicap Fund |

|

Category |

Multicap |

|

AUM (Rs Cr) |

29,551 (As on 30/09/2020) |

|

Fund Manager |

Mr Harsha

Upadhyaya |

|

Benchmark |

Nifty 200 TRI |

What

is a multicap fund?

A multicap fund is an equity fund that needs to stay

invested in a minimum of 65% equities at all times.

There is no restriction with regards to cap or sectors for

multicap funds.

Along with ELSS funds (tax saving mutual funds) it is the

only equity fund that has no restriction as such.

The idea is to allow the fund manager to move across various

caps and sectors depending on the prevailing market conditions.

Multicap funds are the most sought-after funds by retail

investors and are seen as a more stable fund for first time investors.

Additional reading: Click Here to read our complete report of the new SEBI rules on multi cap mutual funds

How is

Kotak standard multicap fund?

Here are a couple of interesting characteristics about this multicap

fund:

- Kotak standard multicap fund has historically been more biased towards industry leaders and heavyweights.

- It is the multicap fund with the highest AUM in the industry.

- Compared to most other multicap funds, kotak multicap fund has a very low turnover ratio.

- Most of kotak multicap’s AUM has been collected during a very short time period.

It has a very focused approach, both in terms of sectors as

well as number of stocks.

Kotak

Standard Multicap Fund Portfolio

Due to the ongoing Covid crisis, the fund has taken a liking

for businesses with strong balance sheets and low fixed running costs.

The fund is underweight on financials, specially NBFC’s and

when you consider the difference between the funds weight and the benchmark

then that is quite a striking one.

The exposure to IT stocks has been increased which has been

the case with most multicap funds and not just kotak standard multicap fund.

There is no space for telecom whereas the fund is currently

very heavyweight on Cements.

Kotak Standard Multicap Fund Strategy

As mentioned previously too, this kotak multicap fund has a

tendency to go for companies that are leading their respective industries.

Therefore, the performance of the fund has more or less

revolved around the benchmark too.

The focus is more on medium to long term growth keeping in

mind reasonable valuations rather than price.

The fund prioritizes growth and therefore avoids momentum picks thereby also having a tendency to underperform in a bull market since downside

protection takes precedence over short term returns.

Kotak standard multicap fund has historically had a very low

turnover ratio, meaning it has allowed its bets the luxury of time to grow and

has had strong convictions.

A major concern with this benchmark hugging approach and a

liking for industry leaders is that it can be quite constrained and also works

as a major hurdle in outperforming the benchmark.

Additional reading: Click Here to read our complete review of Parag Parikh Long term equity fund

What

are the new SEBI rules regarding multi cap funds?

Earlier multi cap schemes needed a minimum 65% investment

into equities with no restriction towards any cap.

Now multi

cap funds would need a minimum investment of 75% into equity (as opposed to

earlier rule of 65%) which would be divided in the following manner:

- Minimum 25% of investment into equity and equity related instruments of large cap companies (as opposed to no such restriction earlier).

- Minimum 25% of investment into equity and equity related instruments of mid cap companies (as opposed to no such restriction earlier).

- Minimum 25% of investment into equity and equity related instruments of small cap companies (as opposed to no such restriction earlier).

These

proposals will come into effect within the first week of February 2021.

How

will the new rules for multi cap funds affect Kotak Standard Multicap Fund?

With the new rules, Kotak multicap fund cannot be more

biased towards industry leaders since it would need to have equal allocation to

mid and small cap sectors and most industry leaders also tend to be classified

as large cap stocks.

Kotak multicap usually takes negligible exposure to small

cap stocks, with the new proposal it would need to raise it up to 25%.

It is a similar story with mid cap stocks but the effect of

it would be lesser than small cap stocks.

There would obviously be changes to the functioning of the

fund and therefore investors would also need to review their expectations, both

in terms of returns and in the way the fund is being run.

Stability and returns, both would need to be viewed with new

eyes.

The fund’s exposure to

small cap stocks is almost non-existent.

Now in order to comply with the latest SEBI rules, kotak multicap would need to allocate 25% of its AUM i.e. 7387.75 Cr to small cap stocks.

This 7387.75 Cr would surpass even the likes of say SBI

small cap fund which had recently closed lumpsum subscription in its fund due

to the lack of quality choices in the small cap sector.

One thing is for sure that once the new rules are complied

with, kotak multicap would be undergoing drastic changes namely:

- The fund would be more volatile as compared to previous times.

- This would be due to higher allocation to mid and small cap stocks, small cap stocks being the more volatile of the two.

- There could be a higher deviation from the benchmark regularly considering the mandatory 50% allocation to mid and small cap stocks and thereby being unable to stick to industry leaders most of the time, if not always.

There

is not anything that would make you sit up and take notice about Kotak Standard

Multicap fund but then again there’s nothing that it has done wrong much to not

gain any attention at all.

Kotak multicap fund’s overall benchmark approach has seen it

play safe, sailing smoothly with industry heavyweights and avoiding momentum

picks. This approach has seen it underperform in a bull market in times of a broad-based

rally.

With an ever-increasing AUM thereby posing liquidity issues,

especially with the recent proposals for mandatory allocation to mid and small

cap stocks and returns that more or less mirror the benchmark more so during a

bull rally one needs to have really strong reasons to invest in Kotak Multicap

Fund when there are far more attractive options which also potentially can be

far more flexible.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com