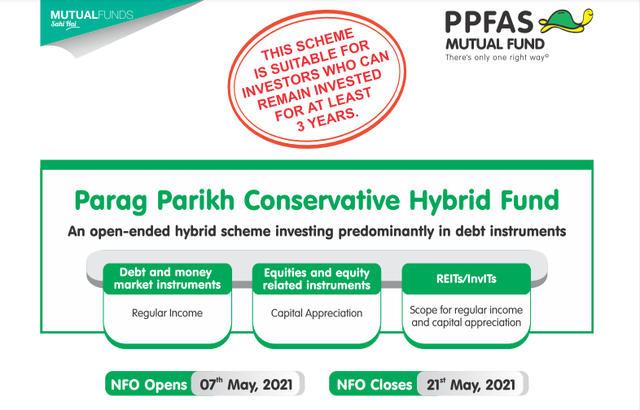

Ppfas conservative hybrid fund is a NFO from the house of

Parag Parikh mutual fund.

The fund would be a hybrid fund on the conservative side

investing primarily in debt securities with a very minimal exposure to

equities.

NFO details for Ppfas Conservative Hybrid Fund

|

Scheme Opens |

07/05/2021 |

|

Scheme Closes |

21/05/2021 |

|

Fund Manager |

Mr. Rajeev Thakkar Mr. Raunak Onkar Mr. Raj Mehta |

|

Benchmark |

CRISIL Hybrid 85 – Conservative Index

TRI |

|

Fund Category |

Conservative Hybrid |

|

Exit Load |

No exit load if 10% of units is redeemed In excess of that, 1% if redeemed

or switched within a year No exit load if redeemed after a

year |

Additional reading: Click Here to read about mutual fund mistakes you should avoid making

Ppfas Conservative Hybrid Fund Investment

Objectives

The

investment objective of this conservative hybrid fund is to generate regular

income by investing predominantly in debt and money market instruments.

The scheme

also seeks to generate long term capital appreciation from equity portion of

the scheme.

There is no

guarantee that the investment objective of the fund would be realized.

Ppfas Conservative Hybrid Fund Allocation

The asset

allocation for the fund would be something like this

|

Asset Class |

Minimum % |

Maximum % |

|

Debt securities (including

securitized debt) & Money market instruments |

75 |

90 |

|

Equity and Equity Related

instruments |

10 |

25 |

|

Units issues by REITS and InvITs |

0 |

10 |

The above

figures are only indicative and not fixed, the fund managers have the liberty

to move across the asset classes depending upon prevailing market conditions as

long as they remain within the mandate permitted.

The fund

can also invest in REITs and InvITs if so desired.

Additional reading: Click Here to read everything you need to know about equity mutual funds

Features of Ppfas Conservative Hybrid Fund

REITs & InvITs

This option allows the fund to try to beat inflation via annual increments.

It opens the possibility of growth in investment value due

to increase in Net Asset Value (NAV).

Equities

The preference would be for stocks with strong cash flows

and higher dividend payout.

Focus will also be on stocks with a high margin of safety.

This stands true for stocks with strong fundamentals too but

are currently out of favour.

It would not be far fetched to assume based on the above

points that the equity portion of this fund would function on similar lines to

the Parag Parikh Flexi cap fund.

Fixed Income Investments

The fund can invest in both, accrual and duration related

instruments.

These include sovereign, state government, PSU and corporate

securities.

Ppfas Conservative Hybrid Fund Options

Pfas Conservative Hybrid mutual fund provides investors with

the following two options

Growth: This option is most suited for investors who are not

seeking dividends or who are not dependent on mutual fund dividends as a source

of monthly income and would rather see their capital appreciate.

Income Distribution cum capital withdrawal :This option is

most suited for investors who are seeking dividends or who are dependent on

mutual fund dividends as a source of monthly income and are not looking for

capital appreciation.

In case you do not opt for a particular option between

growth and income distribution cum capital withdrawal option then the default

option would be growth.

What

is a conservative hybrid fund?

A conservative hybrid fund as the name suggests is a hybrid

fund but on the conservative side.

It invests predominantly in debt securities with a minimum

exposure to equities.

A conservative hybrid fund by regulation requires 75 – 90%

of its total assets invested in debt or fixed income securities.

The remaining 10 – 25% has to be allocated to equities.

Hybrid funds that invest mostly in equities are called

equity oriented funds and those that invest majorly in debt are called debt

oriented funds.

Taxation

on conservative hybrid fund

A conservative hybrid fund because of the mandate to invest

majorly in debt is a debt oriented fund and therefore for tax purposes is also

treated as a debt fund.

LTCG

Long term capital gains tax is applied on gains from a

conservative hybrid funds held for more than 36 months.

The LTCG rate for a conservative hybrid fund is 20% after

indexation.

STCG

Short term capital gains tax is applied on gains from a

conservative hybrid fund held for less than 36 months.

Short term capital gains are added to your income and taxed

as per your income tax slab.

How do

conservative hybrid funds work?

A conservative hybrid fund is less volatile than an equity

fund since the major investments are in debt.

They are however not risk free.

They still have to invest a certain portion in equity which

can be volatile.

The debt portion is also prone to credit and interest rate

risk.

Advantages

of a conservative hybrid fund

A conservative hybrid fund can be considered for a short time

duration unlike equity mutual funds, that is 3 years or less.

Since a conservative hybrid fund invests mostly in debt securities,

it is stable.

This does not negate risk though, it still carries credit

and interest rate risk.

The fund can provide meaningful diversification to a

portfolio.

It holds the potential for capital appreciation via their

exposure to limited equity instruments.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2021 The Mutual Fund Guide, All rights reserved