Quant active fund has recently caught the eye of several

investors, as have most funds from Quant mutual fund.

Even though quant active fund was launched 20 years ago, it

gained attention only recently for obvious reasons.

This should not come as a surprise when you consider its stellar

performance over the past 1 year and its outperformance of its peers by a huge

margin.

When a fund outperforms its peers by a massive distance then

that usually means it has adopted a strategy that no one else in the category

has which makes it worth studying the fund.

What

is quant active fund?

Quant active fund is a multi cap fund from the house of

Quant mutual fund.

It follows the quant model of investing.

At the time of writing, quant active fund remains the only

multi cap fund following the quant model of investing.

While most multi cap funds chose to re categorize as flexi

cap funds to adhere to the new rules on multi caps in January/February 2021,

Quant active fund along with a select few continued to function as multi cap funds.

This was not surprising considering the funds aggressive

approach history as well as the model in place, quant style of investing.

What

is a multi cap fund?

A multi cap fund is a mutual fund that would by mandate need to invest a minimum of:

- 25% in large cap stocks

- 25% in mid cap stocks

- 25% in small cap stocks

The remaining 25% can either be invested in debt,

international equity, cash or any of the above caps or all.

In order to qualify as a multi cap mutual fund, a mutual

fund needs to invest a minimum of 75% in domestic equity divided as described

above.

Additional reading: Click Here to read more about how multi cap funds work

What

is quant model?

The

Merriam-Webster dictionary defines Quant as

‘’An

expert at analyzing and managing quantitative data’’

A Quant based Mutual Fund Scheme is one that is far more driven by number, statistics and data than a macro- economic approach.

Now what constitutes these numbers varies from Fund

House to fund house and at times, even schemes. For some it might be the quarterly results whereas for others it might be the PE ratio.

This approach for example would be more reactive to

the effect of a change in RBI Governor has on the market prices rather than

predicting what effect it would have in the future.

Meaning the mere change in RBI Governor has

absolutely no bearing on its functioning but if the change has an effect on the

stocks it holds and wishes to sell or buy then it would react accordingly.

The stock selection process is quantitative driven

and human intervention is limited, it picks up stocks based on their number

irrespective of other factors.

Robert Merton is considered one of the founding

fathers of quantitative study and this was way before the advent of modern

computers. With modern changes, it was imbibed with technology and is today

used by financial institutions around the world including Fund Managers.

The fundamental approach of this practice is to

break down complex mathematical data to look for alpha or excess return. There

has to be something more than what a Fund Manager can provide and that is where

its value comes into the picture.

Quant

active fund portfolio

As on 30th April 2021, the quant active fund was

overweight on the following sectors:

- Healthcare

- Metals

- Chemicals &

- FMCG

While it was underweight on the following sectors:

- Technology

- Financials &

- Energy

As on 30th April 2021, it held 53 stocks.

Its allocation to the various caps as on 30th

April 2021 is as under:

- Large caps – 33.92%

- Mid caps – 39.84%

- Small caps - 26.24 %

With any fund following the quant model, it does not help in

studying the sectors it is overweight and underweight or its top holdings since

the model does not believe in buy and hold but rather a buy and sell approach.

Which is why the funds exposure to sectors and stocks keeps

changing more frequently than other funds.

This can be better understood by having a look at the fund’s

portfolio turnover ratio.

The fund’s portfolio turnover ratio as on 30th April 2021 was 3.49 times for the past 12 months.

This means that in the last 12 months as on 30th

April 2021, Quant Active Fund’s portfolio was completely changed 3 times which

is a big for any mutual fund scheme including aggressive schemes like small,

value and thematic.

But with a quant model this is to be expected since it is

data driven, it does not apply a buy and hold strategy but rather a buy and

sell strategy.

So if a particular stock does not fall within that purview, irrespective

how fundamentally strong it is, it will be shown the door.

Additional reading: Click Here to read our complete review of Quant Tax Plan

Is

quant mutual fund safe?

Quant mutual fund as a model is not a new model internationally.

Although quant mutual funds are still less in

numbers due to how volatile this approach can be.

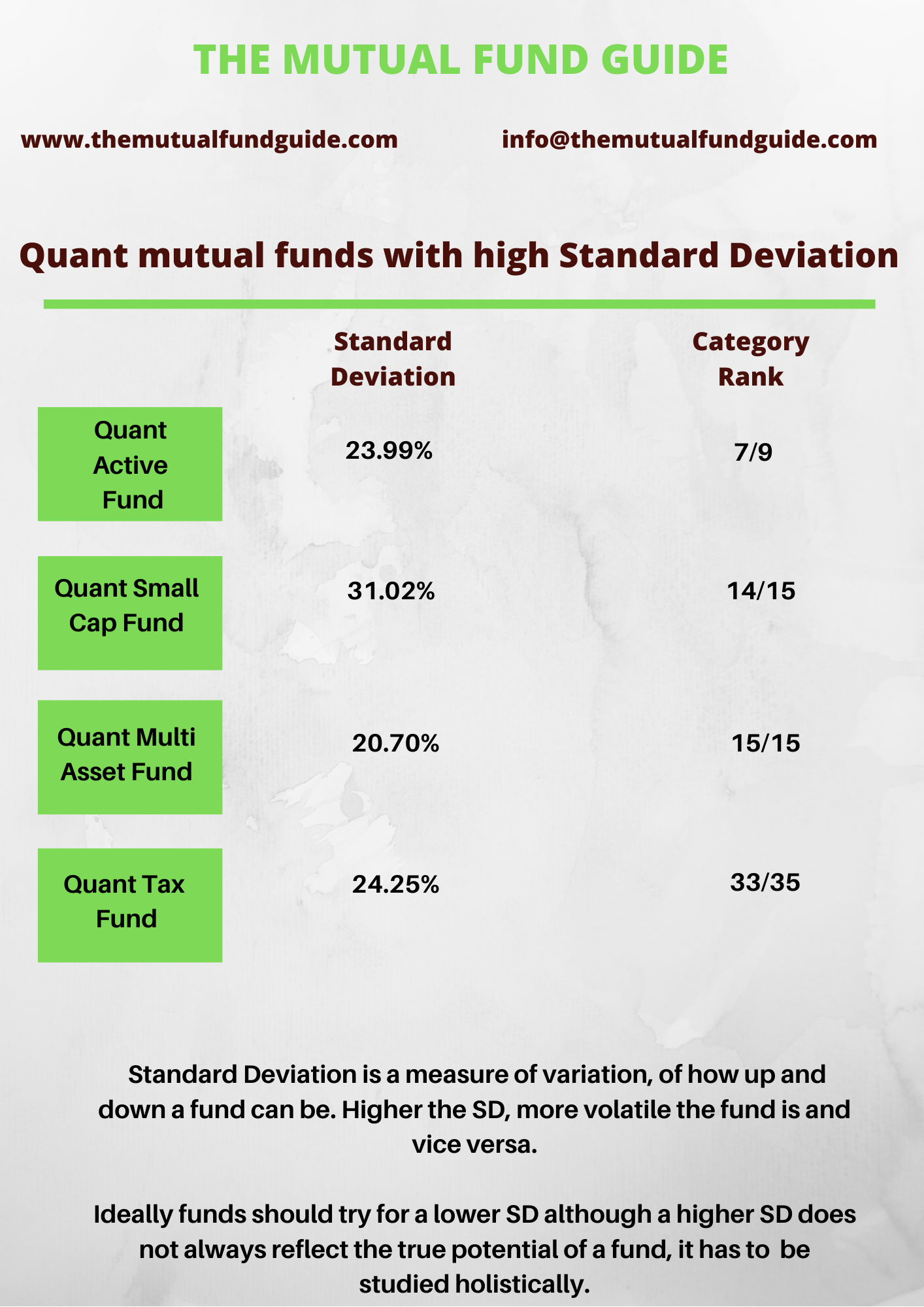

This can be backed by their high standard deviation.

Higher the standard deviation, more volatile the fund and

vice versa.

It is easy to be carried away by one year returns but that

is what differentiates a long-term investor from a short-term gambler.

You do not invest in mutual funds for a year, if you do then

good luck! (you are going to need it)

Studying past returns is of little use since the portfolio

has a high turnover ratio based on a model with little human intervention.

As much as this model can garner exorbitant returns in one

year, can it do so sustainably over 5 years or more and is such a volatile

model worth your constant stressing is what you really need to ask yourself.

Is

quant mutual fund good?

It is only natural for such a question to pop up given how

novice the idea is domestically.

Rather than good, the more apt question would be whether it

is suitable.

Irrespective of when you enter the fund, it will always be

volatile even with a stp method.

Which means you cannot utilise a quant mutual fund for a long term

goal in case you plan to do a swp when your goal is nearby (which you should

ideally).

You cannot therefore consider quant active fund or for that

matter any quant mutual fund for a long term set goal because

such funds tend to be volatile and if you need the money at a set time and the fund

is going through its usual correction phase, you would be forced to redeem at a

loss.

Quant mutual funds have a higher exposure to mid and small

cap stocks, even in funds they are not required by mandate.

So a quant model in a large or hybrid fund will give high

returns in a short period but it will not provide downside protection which is

the theme for such conservative funds.

Are

quant funds better?

Quant mutual funds are no better than non quant funds.

They may and can boast a far superior one year returns but

not consistently.

This brings into question the long term effectiveness of

such a model.

The risk reward ratio does not justify the volatility even

for a small portion of your overall portfolio.

One year returns are tempting but they will always be for

all types of mutual funds, let alone quant mutual funds.

Equity mutual funds were never, are not and will never be recommended

for a one year period.

India is still an emerging

economy, it is way more sensitive in its reactions as compared to other

developed economies. This is far more the case when it comes to mid, small,

large & mid and even value schemes.

Expecting an algorithm to handle aggressive schemes that take the most beating

in a market slump may not exactly be the most prudent thing to do.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2021 The Mutual Fund Guide, All rights reserved