Mirae asset

mutual fund as a fund house has only recently caught the eye of both investors

and analysts at large.

This has

always been the trend though, when more than one scheme of a mutual fund house

generates more than average returns then it is bound to get both attention as

well as AUM.

While

understanding the reasons for the under performance of a scheme is important,

equally important is understanding the reasons for out performance of a scheme.

How

mutual funds invest?

- Every mutual fund house usually has several equity mutual fund schemes.

- Going by the SEBI rules though, a fund house cannot have more than one fund in the same category.

- Every fund house will have a CIO and head of equities.

- Certain fund houses have a similar strategy throughout all their equity schemes whereas some run each equity mutual fund scheme distinctly.

There is no one size that fits all.

Parag Parikh mutual fund for example has a similar strategy

for both their equity schemes (flexi cap and tax fund) whereas Birla and

Edelweiss mutual fund has a much more diversified strategy throughout their

equity schemes.

As an investor therefore you need to be well aware if your

mutual fund is truly diversified or merely has different schemes investing in

the same stocks.

Another point to take into account is when you invest in two

different schemes of the same fund house and if they are bullish and

bearish on the same sectors then there is a high chance of

overlapping.

Additional reading: Click Here to read more about how mutual funds are taxed

Mirae

Asset mutual fund overlapping issue

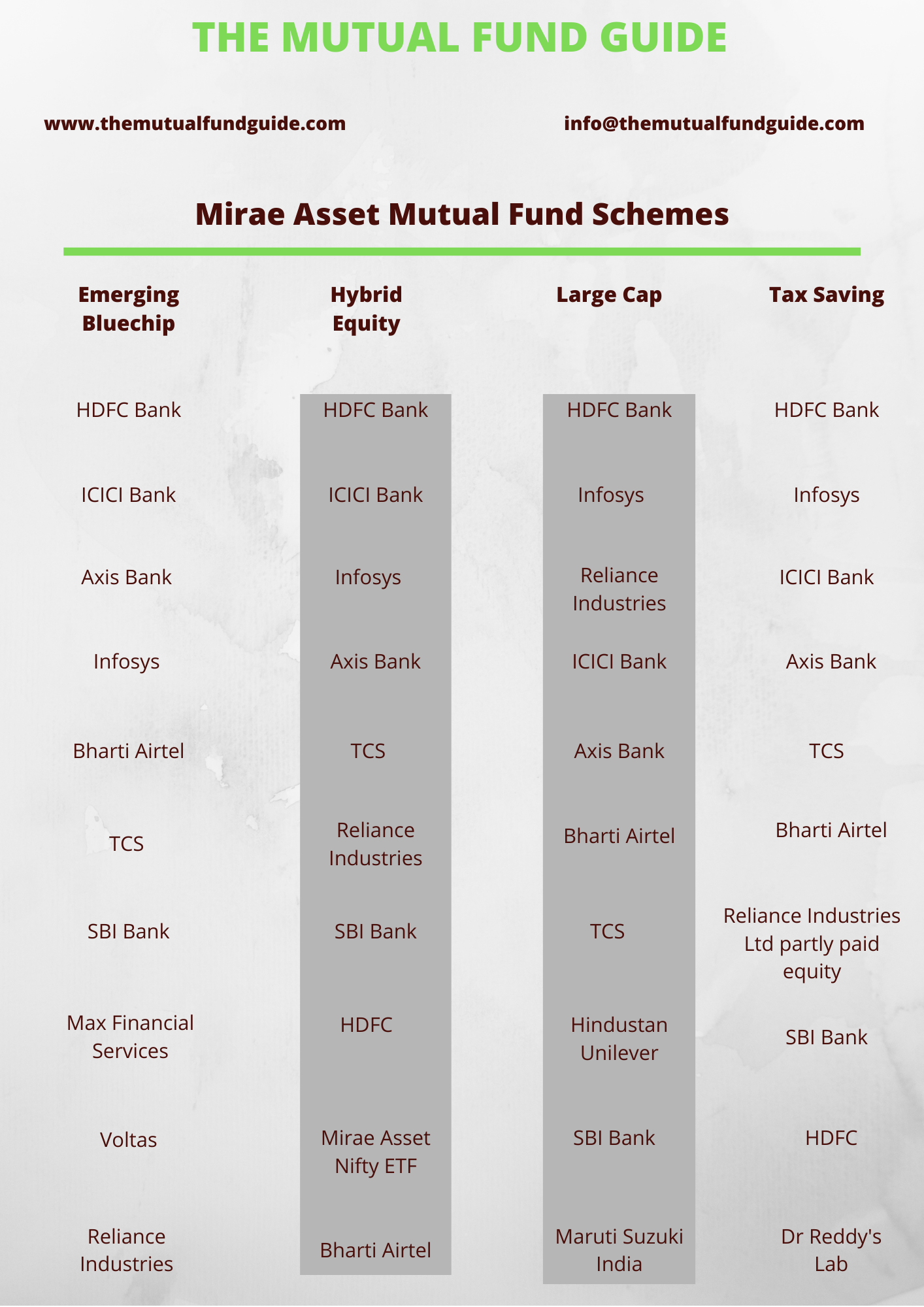

70 % of the top 10 stocks in the following funds:

- Mirae Asset Emerging Bluechip fund

- Mirae Asset Hybrid Equity fund

- Mirae Asset Large cap fund

- Mirae Asset Tax saving fund

are all invested in the same companies.

There is not much difference even in the allocation of these

stocks across all mirae asset mutual fund schemes.

It is not uncommon for a fund house to be bullish and

bearish on certain stocks and sectors across all their schemes.

Therefore it should also not come as a surprise when all or

most schemes of a particular fund house have a similar strategy.

Therefore if as an investor if you had invested in these

various schemes under the illusion of diversification then unfortunately you

were taken for a ride and you have no one to blame for that than yourself.

This is a lot more common with retail investing though,

investing in schemes of a ‘popular’ fund house without analysing whether or not

the portfolio is aligned to one’s goals.

Another common reason is when these schemes have

outperformed their peers in the recent past.

Additional reading: Click Here to read about the various types of equity mutual funds

Sectoral

exposure of Mirae Asset mutual fund

As expected, there is not much difference even in the top

sectors of the four schemes in question.

The top 5 sectors for all the four schemes are the same:

- Financial

- Technology

- Healthcare

- Energy and

- FMCG

In fact, there is not much difference even in the allocation to the above sectors among the four schemes of mirae asset mutual fund.

Every mutual fund house and mutual fund scheme will have

their own reasons to be bullish and bearish on certain sectors.

The sectors they are bullish on are the ones from where they

pick stocks to invest in and the sectors they are bearish on find negligible to

no stocks to invest in.

It is important to note here that merely because a

particular sector is under performing at the moment does not necessarily mean

the fund house got it wrong, some are also cyclical calls from a long term

perspective.

Then there is the case of a fund house not necessarily going

by sector but rather by stocks, meaning investing in stocks they are bullish

irrespective of what sector they belong to.

When things are smooth investors do not realize how over

lapping their portfolio is despite investing in different schemes, it is only

when things go down south do they notice their portfolio is not diversified.

Diversification should not be undertaken with the aim of

amplifying returns but rather should be done with the purpose of diversifying risks.

Investing in mutual funds is as much about protecting gains

as it is about making gains.

Allocation

in Mirae Asset mutual funds

As mentioned earlier, all the four schemes of mirae asset

mutual fund have more or less the same stocks in its top holdings as well as

the allocation to them.

This is despite all the four schemes belonging to different

categories namely:

- Large cap mutual fund

- Large & mid cap mutual fund

- Hybrid Equity mutual fund

- ELSS Fund (tax saving mutual fund)

A large cap mutual fund needs to invest minimum 80% in large

cap stocks.

A large & mid cap mutual fund needs to invest a minimum

of 35% each into large cap and mid cap stocks.

An aggressive hybrid mutual fund needs to invest a minimum

of 65% into equities and maximum 80% at all times.

A tax saving or an elss mutual fund needs to invest a

minimum of 80% into equities at all times.

All the four schemes mentioned above belong to different

categories and also mandates they need to adhere too.

As an investor your natural instinct is to invest in

different categories in the belief that they would provide diversification to

your portfolio.

This is not enough though because true diversification is

when you can actually explain your diversification cause if not then your

portfolio is a sitting duck for an unmitigated disaster.

Diversification is not as easy as investing in different

schemes of the same fund house or even different, it is not as easy as

investing in different schemes across different fund houses.

Diversification is about your schemes adopting different

strategies, even if they belong to the same fund house so there is

diversification of risks and diversification of risks is a strong platform for

decent returns.

This write up should by no means be seen as discouraging or

encouraging you to invest or not invest in a particular fund house.

The point remains that diversification remains a tricky subject

for most investors and not being able to implement it well leads to otherwise

avoidable issues in the form of:

- Exit load

- Taxes etc.

As a thumb rule, diversification is about investing in

different strategies and not just funds because various funds can adopt the

same strategy.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2021 The Mutual Fund Guide, All rights reserved