Parag

Parikh Long Term Equity fund has received the necessary approval from SEBI

(Securities and Exchange Board of India) with regards to recategorizing its

name as well as category.

The fund

was earlier named as Parak Parikh Long Term Equity Fund but with effect from

January 13, 2021 would be known as Parag Parikh Flexi Cap Fund.

Parag

Parikh Long Term fund was earlier a multicap mutual fund but henceforth would

be recategorized as a flexicap mutual fund.

|

|

Existing |

Revised |

|

Scheme Name |

Parag Parikh Long Term Equity Fund |

Parag Parikh Flexi Cap Fund |

|

Scheme Category |

Multicap Fund |

Flexi Cap Fund |

Segregated Portfolio

Parag

Parikh mutual fund has also decided to include provisions for a segregated

portfolio in the SID (Scheme Information Document) of debt and money market

instruments.

What is segregated portfolio in mutual fund

schemes?

A segregated portfolio in a mutual fund scheme helps in:

- Reducing redemption pressure

- Reducing a big fall in nav of schemes

- Protecting good quality papers

How a segregated portfolio helps?

Even though

all AMC’s and mutual fund schemes have their own stringent internal evaluation

systems in place, the fear of credit downgrade in portfolio companies is very

much real.

The instrument that is downgraded becomes illiquid making it

difficult for the fund manager to sell off the downgraded instrument.

If the downgraded instrument is not segregated, it affects

the returns of the other portion of the portfolio thereby negatively affecting

even the more liquid and better performing assets.

The

Securities and Exchange Board of India (SEBI) had on 11/09/2020 issued a

circular bringing about changes to fundamental characteristics of Multi Cap

mutual funds.

Existing rules for Multi Cap mutual funds

Presently multi cap mutual funds need to invest a minimum of 65% of total assets into equity.

This 65% is

needed for any equity fund and not just multi cap mutual funds to qualify as

equity funds which has a favourable tax proposition.

This 65% is

only minimum which can even go up to 100% in case the fund manager so desires.

Whatever

the allocation between 65% to 100%, there is no restriction with relation to

large cap, mid cap or small cap stocks.

Revised rules for Multi cap

mutual funds

Minimum

investment of 75% into equity (as opposed to earlier rule of 65%) which would

be divided in the following manner:

- Minimum 25% of investment into equity and equity related instruments of large cap companies (as opposed to n0 such restriction earlier).

- Minimum 25% of investment into equity and equity related instruments of mid cap companies (as opposed to no such restriction earlier).

- Minimum 25% of investment into equity and equity related instruments of small cap companies (as opposed to no such restriction earlier).

These

proposals will come into effect within the first week of February 2021.

Additional reading: Click Here to read our complete report on everything that you should know about a Mutual fund NAV.

Parag Parikh Long Term Equity Fund strategy

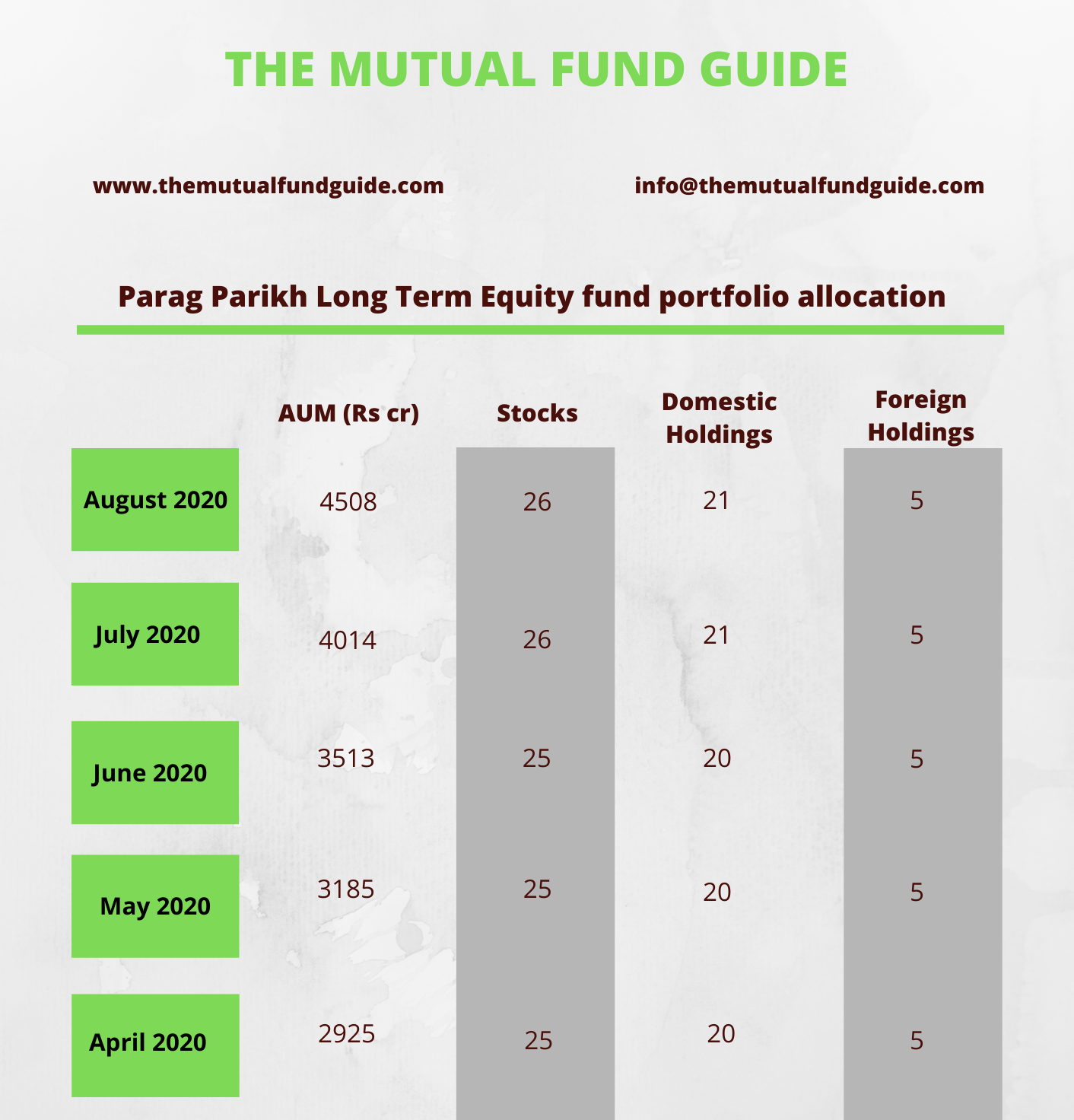

Parag

Parikh long term equity has a focused approach despite being

a multi cap fund.

It

comparatively has higher cash holdings and is the only multi cap fund at the

moment to have foreign holdings along with domestic companies.

The fund

has a tendency to underperform in a bull phase of the market due to not

succumbing to momentum picks and outperform its peers in a bear phase due to

higher cash holdings along with a limited number of stocks.

With

regards to its foreign holdings, historically it has stuck with US bluechip

companies and that too within the IT space.

Suzuki

Motor Corporation is the only exception to this, it is picked despite it being

listed on the Indian stock exchange too due to its rather attractive valuation abroad.

Possible explanation for this new proposal

The

regulator believes that most multi cap mutual fund schemes were basically large

cap schemes in terms of their asset allocation disguised as multi cap funds.

These multi

cap funds were therefore not true to their label.

There is an

element of truth but existence of truth does not imply a lie part as well, the

universe is not as binary as we believe so.

Sure, most

multi cap funds presently are more large cap biased but we also need to

understand the reasons behind the same rather than simply drawing conclusions

based on current allocations

The Indian

stock market has been more or less volatile during the last few years and large

cap stocks provide more stability than mid and small cap stocks.

Large cap

stocks do not face liquidity issues as much as mid and small cap stocks.

The idea

behind a multi cap fund is to allow the fund manager freedom to move around

various sectors based on his understanding of the market.

A multi cap

fund at the end of the day is still an actively managed fund that needs

constant overlooking to make sure the overall portfolio is balanced.

Investors

looked at multi cap funds as a safe and uncomplicated haven since they did not

have the burden or compulsion of being confined to sectors like say in the case

of mid cap, small cap, large & mid cap, thematic mutual funds, etc.

A multi cap

fund was one fund where the fund manager would deviate across various sectors,

caps and themes based on market movements.

Interesting

facts about Parag Parikh long term fund

Exit Load : Unlike other equity mutual funds, Parag

Parikh Long Term Equity Fund has a 2% exit load if redeemed within 365 days. This

has been put into place to deter investors with a short term horizon in equity

investing.

No Dividend Option : The fund does not offer dividend

option so that investors can avail the true benefits of compounding.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com