Hybrid funds are a mixture of two or more asset classes.

They try to strike a balance between returns and risks.

The equity portion strives for capital appreciation to beat

inflation and the debt portion strives for stability.

Hybrid funds can be either equity-oriented funds or

debt-oriented funds.

Hybrid funds can be divided in the following manner:

- Aggressive hybrid fund

- Conservative hybrid fund

- Multi asset allocation

- Equity savings fund

- Dynamic asset allocation fund

- Arbitrage fund

Aggressive

hybrid mutual funds

An aggressive hybrid mutual fund needs to invest a minimum

of 65% into equity at all times which can go up to 80% maximum if so desired.

The debt portion should be at a minimum of 20% at all times.

An aggressive hybrid fund has a higher equity proportion while

a conservative hybrid fund has a lower equity portion.

Therefore, an aggressive hybrid mutual fund is taxed as an

equity fund whereas a conservative hybrid fund is taxed as a debt fund.

Advantages

of Aggressive Hybrid mutual funds

An aggressive hybrid mutual fund is often perceived as a

good low risk initial step into mutual funds for a first-time mutual fund

investor.

The key word here being ‘low’.

Mutual funds were, are and will be always be risky, be it

equity or debt.

Aggressive hybrid mutual funds though tend to be less

volatile as compared to the following categories:

- Multicap mutual funds

- Large & Mid cap mutual funds

- Focused mutual funds

- Mid cap mutual funds

- Small cap mutual funds and so on.

Another key advantage of an aggressive hybrid mutual fund is

that you do not have to worry about asset allocation or re balancing.

This will be taken care by the fund manager.

If the fund manager believes the market is over valued then she

can reduce the fund’s equity allocation and if she believes the market is under

valued then she can increase the fund’s equity allocation.

This does not mean she has to, it merely means she has the

option to in case she chooses to.

What

is a conservative hybrid fund?

A conservative hybrid fund as the name suggests is a hybrid

fund but on the conservative side.

It invests predominantly in debt securities with a minimum

exposure to equities.

A conservative hybrid fund by regulation requires 75 – 90%

of its total assets invested in debt or fixed income securities.

The remaining 10 – 25% has to be allocated to equities.

Hybrid funds that invest mostly in equities are called

equity oriented funds and those that invest majorly in debt are called debt

oriented funds.

How do

conservative hybrid funds work?

A conservative hybrid fund is less volatile than an equity

fund since the major investments are in debt.

They are however not risk free.

They still have to invest a certain portion in equity which

can be volatile.

The debt portion is also prone to credit and interest rate

risk.

Advantages

of a conservative hybrid fund

A conservative hybrid fund can be considered for a short

time duration unlike equity mutual funds, that is 3 years or less.

Since a conservative hybrid fund invests mostly in debt

securities, it is stable.

This does not negate risk though, it still carries credit

and interest rate risk.

What

is a Multi Asset Fund?

A Multi Asset fund means a mutual fund that invests in three

or more asset classes.

Not all the multi asset mutual fund schemes were multi asset

funds to begin with though.

Some were merged with other schemes after SEBI’s

recategorization exercise in 2018 while some were launched after 2018 like

Motilal Oswal Multi Asset Fund and Nippon Multi Asset Fund.

This is also the only category in the mutual fund universe

where the taxation system applicable varies from scheme to scheme and there’s

no one tax system for the entire category.

How do

multi asset funds work?

Multi asset mutual funds invest a minimum of 10% each in

three or more asset classes.

10% is minimum but the fund manager can go as further as he

wants to as long as a minimum of 10% is invested in three or more asset

classes.

Assets usually invested in by Multi asset funds include but

are not limited to :

- Equity

- Debt

- International Equity

- Gold etc.

The basic idea behind a multi asset mutual fund is to try

and get the best out of each asset class with regards to both returns as well

as diversifying risks.

Different asset classes perform well at different times and

a multi asset mutual fund tries to capture each asset class when it is doing

well and reduce allocation in the asset class that is performing poorly or the

forecast for the same is poor.

Additional reading: Click Here to read our complete report on everything that you should know about a Mutual fund NAV.

Equity

Savings Fund

Equity savings fund are an open-ended hybrid fund investing

in equity, arbitrage and debt.

They need a minimum of 10% to be invested in debt funds

securities.

Equity savings fund are relatively new as a fund category,

they came into existence only after SEBI’s new regulations with regards to fund

mandate in 2018.

They invest in arbitrage opportunities to take advantage of

pricing in cash and derivatives.

Unlike other hybrid funds (except arbitrage) an equity

savings fund’s overall equity exposure is partially hedged thereby reducing its

overall volatility.

How does equity savings fund work?

Diversification

Since an equity savings fund invests in equity, debt and

arbitrage opportunities it provides decent diversification by itself.

It saves an investor the need to invest in those three

mentioned asset classes separately.

Taxation

Despite an equity savings fund investing a sizeable portion

in debt, the fund is still treated as an equity fund for tax purposes.

For tax calculation, equity funds are much more desirable

than debt equity funds.

The arbitrage position helps the fund to qualify as an

equity fund since it is the net exposure that counts eventually.

Stability

The equity portion of the fund provides capital appreciation

whereas the debt portion provides protection.

The overall structure therefore provides stability.

One still needs to do a thorough study though since debt

funds can also have credit and interest rate risk.

Dynamic

Asset allocation fund

A dynamic asset allocation fund is more popularly known as a

balanced advantage fund.

A balanced advantage fund is a type of hybrid fund.

It invests in debt, equity and arbitrage positions although

the allocation is not fixed.

It can also sit on cash if the fund manager desires so.

Unlike other hybrid funds like multi asset, aggressive and

conservative, a dynamic asset allocation or a balanced fund does not have a

fixed mandate to follow.

The fund manager can move across different asset classes

based on the prevailing market conditions.

The importance of a balanced fund is more felt during a bearish

market phase since it can cut down its equity portion and at the same time make

periodic equity purchases in the dip.

This is unlike other pure equity funds who at all times have

to maintain their mandate irrespective of the market situation.

Arbitrage

funds

Arbitrage stands for the concurrent purchase and sale of the

same asset in different markets with the intention to exploit the difference in

price.

In an arbitrage fund, a fund manager attempts to buy at a

lower price in one market and then try to sell the same asset in another market

at a higher price to make profit.

Arbitrage positions are not always and easily available

though.

For tax calculation purposes, they are treated as any other

equity fund.

What

is the difference between equity/debt and hybrid mutual funds?

A pure equity fund will be taxed as an equity fund.

A pure debt fund will be taxed as a debt fund.

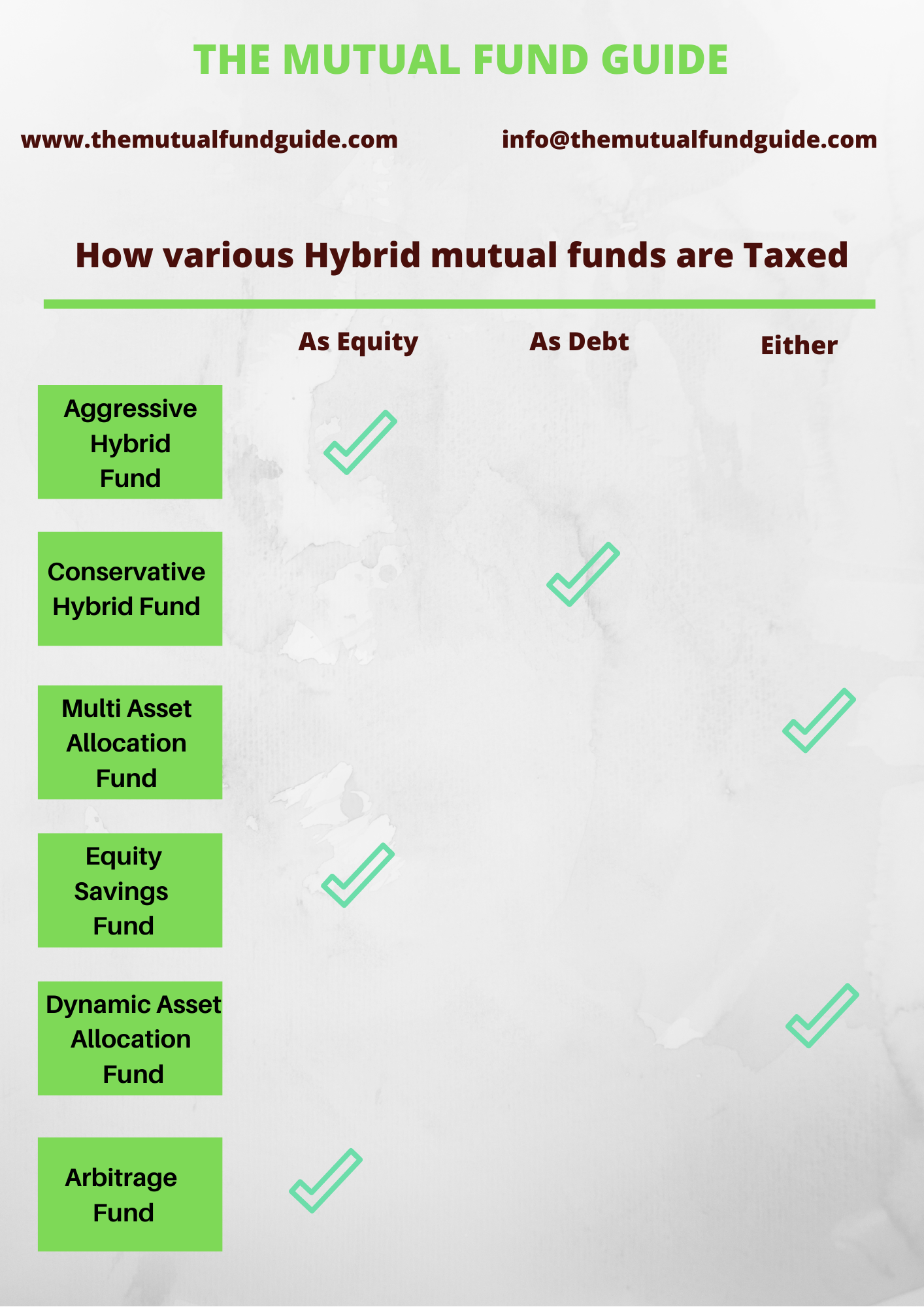

There is no uniform tax rule for hybrid funds as a category

though, each fund will be taxed as per the prevailing asset allocation.

In fact, within the multi asset hybrid fund category too,

there is no uniformity with regards to taxation.

A hybrid fund is mixture of two or more asset classes,

usually equity and debt.

Whereas with an equity fund, equity is the more prominent

asset class and with a debt fund, debt.

Taxation

on hybrid funds

There is no uniform taxation rules for hybrid funds, they

are taxed based on whether the fund qualifies as an equity fund or debt fund.

LTCG

For hybrid funds that qualify as an equity fund LTCG is applied

on gains held for more

than a year and are more than 1 lakh.

The LTCG rate is 10%.

Capital gains up to 1 lakh are exempt for taxes.

There is no indexation benefit when calculating LTCG.

STCG

Short term capital gains tax better known as STCG is applied

on gains from hybrid mutual funds which are held for 12 months or less.

The STCG rate is 15%.

There is no ceiling benefit in STCG like the 1 lakh ceiling

in LTCG.

STCG is charged on from Re 1.

LTCG

For hybrid funds that qualify as a debt mutual fund, long term capital gains tax is

applied on gains held for more than 36 months.

The LTCG rate is 20% after indexation.

STCG

Short term capital gains tax is

applied on gains held for less than 36 months.

Short term capital gains are added to your income and taxed

as per your income tax slab.

For multi asset allocation funds the tax structure applied

here differs from scheme.

If a particular multi asset mutual fund has an equity

allocation of minimum 65% then it is taxed as an equity mutual fund whereas a

multi asset mutual fund that does not have a minimum 65% equity allocation is

taxed as a debt mutual fund.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2021 The Mutual Fund Guide, All rights reserved