Parag Parikh Long Term Equity Fund

Fund ManagerMr Raj Mehta & Mr Raunak Onkar

Category:

Date of Inception: 28

Benchmark: Nifty 500 TRI

How is Parag Parikh Long Term Equity Fund?

Parag Parikh Long Term Equity is a

Multi Cap Fund that follows the value investing philosophy.

The Fund House makes it absolutely

clear that their objective is long term growth, they have also clearly defined

that ‘long term’ stands for 5 years and more.

Since the Parag Parikh Long Term Equity Fund follows value investing philosophy, it therefore looks for companies at a price much lower to its intrinsic price, the difference between the two is the value you receive for following such a strategy.

Since the Parag Parikh Long Term Equity Fund follows value investing philosophy, it therefore looks for companies at a price much lower to its intrinsic price, the difference between the two is the value you receive for following such a strategy.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Investment Philosophy of Parag Parikh Long Term

Equity Fund

- Since Parag Parikh Long Term Equity is a Multi Cap fund, it is not restricted to any one category. It can invest across various sectors in varying allocations as it pleases.

- The only point of restriction is a minimum of 65% investments into Equities in order to qualify for equity taxation.

- It is also one of the rare schemes to invest in International markets without losing the tag of an Indian Multi Cap.

- It looks for companies with strong fundamentals that are currently down but are expected to recover in time and overcome the downtime.

The above logo of the Fund House is

very well thought out.

The first thing that will most likely

cross your mind on seeing a tortoise is its slow speed but the logo actually

signifies the longevity of a tortoise.

The Fund similar to a tortoise,is not

interested in how ‘quickly’ you make money but rather you stay invested for a

long term. Tortoises generally have one of the longest life spans of any animal

in the world.

The Fund with its logo as well as its

written communication has made it very clear that Parag Parikh Long Term Equity

Fund is only meant for long term investors (more than 5 years) who are not

seduced by short term growth and rampant returns.

Click Here to read our review of Parag Parikh Tax Saver Fund

Click Here to read our review of Parag Parikh Tax Saver Fund

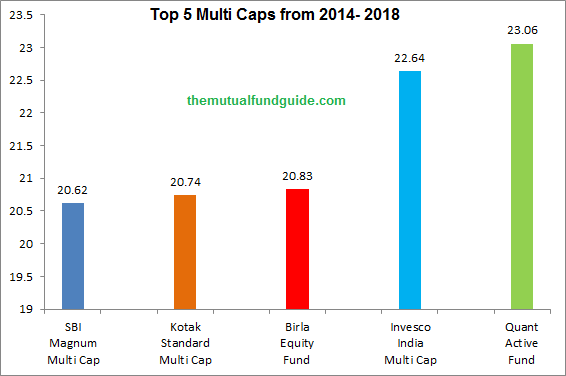

Parag Parikh Long Term Equity compared to other Multi Caps

So

Parag Parikh does not feature in the Top 5 Multi Caps for the past five years

but should this come as a surprise?

No

!

The

ultimate purpose of this fund is not to give you the highest returns but to maintain consistent returns with a lower volatility.

This is why even after 10 years you may

not find this fund in the top 5 list and that is quite understandable

considering the purpose of the fund.

If your only reason to invest in a

Multi Cap fund is high returns then stay away from Parag Parikh Long Term Equity since this fund has always been mediocre in a bull run because of its strategy.

Difference between Parag Parikh Long Term Equity Fund and other Multi Cap funds

As can be seen from the above image, when the markets do really well, the fund still lags behind its peers when it comes to overall returns.

Now

let’s look at another picture

Except for say may be Kotak Standard

Multi Cap fund, when most other Multi Cap funds have struggled in a market slump, Parag

Parikh Long Term Equity Fund has been able to hold its fort.

This is also why Parag Parikh Long Term Equity vs Kotak Standard Multicap Fund is a very interesting debate since both are large cap biased and mirror each others performance.

The reason for this is quite simple,

Parag Parikh Long Term Equity Fund does not chase momentum stocks.

A momentum stock is one which may be on

the up for a certain period due to favourable conditions but will struggle in

the long run due to weak fundamentals.

Reasons for consistent performance in Parag Parikh Long Term

Equity Fund

As we have seen above on comparing

with the top 5 Multi Cap funds, we see that Parag Parikh Long Term Equity falls the least during a

bearish phase.

This can be further studied by looking

at the standard deviation of all the top 5 Multi Cap funds along with Parag Parikh

Long Term Equity Fund.

- A standard deviation is basically used to measure the volatility of the fund.

- A lower volatility does not necessarily mean the fund is better nor does a higher volatility make a fund worse.

- A fund with a lower standard deviation does mean though that it falls less when the markets are in red as compared to its peers.

- Do not fall into the trap of picking a fund only due to its low standard volatility, as long as the short term fluctuations justify the long term growth, you are doing well.

- This is precisely why when you compare the returns of Parag Parikh Long Term Equity with the other Multi Caps in 2018, it is quite evident that the fund has fallen the least comparatively and this is one of its strong points.

Is Parag Parikh Long Term Equity a Multi Cap or Focused Fund?

The first 3 mutual fund schemes going by their

Scheme Information Document (SID) are Focused Funds whereas Parag Parikh Long

Term Equity Fund is a Multi Cap Fund.

The regulator has not segregated

Focused funds separately but most research websites and investors tend to look

at them as Multi Caps. Now the biggest difference between the two set of

categories is in the number of stocks they hold. A multi cap does not have any

restriction with regards to the number of stocks it can hold but a focused fund

usually does.

Now despite this if you look at the

above table, you can make out that Parag Parikh Long Term Equity which is a

Multi Cap Fund holds less number of stocks as compared to SBI Focused Fund and

Motilal Oswal Multi Cap 35 Fund which are Focused Funds.

Issues with Parag Parikh Long Term Equity Fund’s focused

approach

When you take a focused approach, you

run the risk of being unnecessarily over dependent on a couple of stocks. If

your exposure to one particular stock is high and God forbid it tanks, the

entire portfolio takes a hit.

There is no guarantee that this will happen

but then again there is no guarantee that it will not.

In the world of Equity Investing it is

better to err on the side of caution.

A very good example of the risk of

unnecessary exposure towards a small group of stocks is the Motilal Oswal

Multi Cap 35 Fund and the effects of the Manpasand Beverages fiasco on it.

|

Parag Parikh Long Term Equity Fund and International

Diversification

The Fund has taken exposure to

International markets for the following reasons:

- To avoid losses in case domestic country’s economy is down.

- To avoid losses in case domestic country is facing disasters, both natural and man-made like earthquake, war, etc.

- To take advantage of growth in other countries.

As on 30th April 2019, the

Fund held the following 3 stocks in the top ten holdings:

- Alphabet Inc Class C (USA)

- Facebook Inc A (USA)

- Suzuki Motor Corp (Japan)

The main objective of the fund is not immediate or high returns but

rather consistent returns.

In

the list above of 3 stocks in top ten holdings, 1 is from Japan whereas the

remaining two is from USA.

The US is far more stable as compared

to India but does not possess the same growth potential as the Indian markets.

Same is the case in Japan. With these cases again the point is very clear, the

reason to invest in these markets is to avail stability with geographic

diversification and not returns per se.

In face the US and India markets have

an extremely low co-relative rate (less than 1%). This means the chances of

over lapping between the two is very slim.

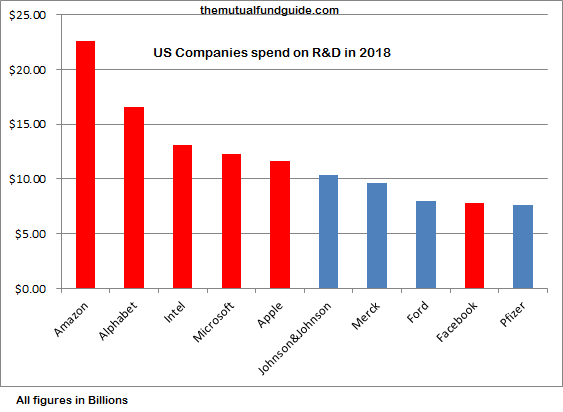

Another interesting point to note is

that both their investments into the US markets are in data driven companies

with heavy R&D.

Cash Holdings of Parag Parikh Long Term Equity

Fund

The Fund unlike other Multi Cap Funds

holds a good proportion of the portfolio in cash.

This of course is not a strategy that

is widely accepted or even recommended and rightly so. Since it expects the

Fund Manager to know precisely how the market is supposed to work (AKA timing

the market.)

This puts the Fund Manager under undue

stress, this is more so the case when opportunities are few and far.

This coupled with a Focused approach in

a Multi Cap Fund seems unnecessary.

Click Here to read how Axis Mutual Fund used the Cash strategy in 2019.

Portfolio Turnover Ratio of Parag Parikh Long

Term Equity Fund

As can be seen from the image below the

Fund has a very low portfolio turnover ratio as compared to other multi cap funds.

A portfolio turnover ratio gives you an

idea of the number of times a portfolio has been churned.

It is a myth that a higher portfolio

ratio is unhealthy and vice versa.

The reason why Parag Parikh Long Term

Equity Fund has such a low portfolio turnover ratio is because it has a buy and hold

approach rather than a buy at a low and sell at a high approach.

The latter is what Aditya Birla Pure

Value Fund does thereby proving how one strategy can be used differently by

Fund house and Fund managers.

Click Here to read our complete review of Aditya Birla Pure Value Fund

Some interesting facts about the fund

Skin

in the game: As on 30th April 2019, the

combined holding of ‘insiders’ in the fund was about 6.65% of the AUM. In

simple language, they invest where they ask you to invest.

Exit

Load: Unlike other equity funds, Parag Parikh

Long Term Equity has a 2% exit load if redeemed within 365 days. This has been

put into place in order to deter investors with a short term horizon in equity

investing.

No

Dividend Option: The Fund does not offer Dividend option so that investors can avail the true benefits of Compounding

Got some questions ? We've got the answers

email us at info@themutualfundguide.com

Disclaimer : While due precaution has been undertaken in the preparation of this article, The Mutual Fund Guide or any of its authors will not be held liable for any investments based on the above article. The above article should not be considered financial advice and has been published only for your perusal. Due credit has been given in case wherever required, in case you feel any part violates any rights then do get in touch with us and we shall get it duly removed.

Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing

Copyright © 2019 The Mutual Fund Guide, All rights reserved.