Aditya Birla Pure Value Fund

Fund Manager: Mr. Milind

Bafna Jain

Category: Value

Date of Inception: 27th March 2008

Aditya Birla Pure Value Fund is a fund that follows a value investing approach to its portfolio. There is no bias to any category or sectors. Value funds if aligned with market conditions outperform other funds but also tend to be extremely volatile in the short run but very rewarding in the long run.

As an investor the biggest challenge is not to panic when the fund is under-performing and to maintain patience looking at the bigger picture.

What is Value Investing?

Value investing as the very name suggests, is all about the value. It is very important you do not confuse price with value here, price is what you pay but value is what you get.

Value investing as the very name suggests, is all about the value. It is very important you do not confuse price with value here, price is what you pay but value is what you get.

Imagine a situation where you buy a smartphone online.

Now consider two possibilities

Possibility A

You buy the smartphone during a sale.

Possibility B

You buy the smartphone when there is no sale.

- The general assumption would be that the price of the smartphone would be less during a sale as compared to when there is no sale.

- This is not completely true because technology is ever changing so the price of the smartphone over a period of 1 year keeps varying. Also just cause you bought the phone during an online sale does not mean it was cheap, it only means you were made to believe it was cheap.

- Irrespective of when you buy it though, it will be the same product but whether the price you paid for it is worth it or not will be up for debate.

Let us apply the above scenario to stock selection

You could argue that it would be wise to pick stocks the

same way you buy a smartphone during a sale.

Well a couple of points would negate that aspiration of

yours

a) For starters there is sale of stocks as you have with say

an online sale on Flipkart or Amazon.

b) Secondly just because something is cheap, it becomes all

the more important to understand why it is cheap. It could be cheap since the

stock itself is a poor choice or due to market conditions when every other

stock is also down.

A stock can be down due to various macroeconomics factors

beyond its control.

Discarding the wheat from the chaff becomes all the more difficult in a market slump.

Now it is not mandatory only stocks that are down are looked

at when using the value investing approach. A certain stock may not be down but

it may still seem as undervalued when you look at its future potential.

It is all about valuations but subjectively.

It is all about valuations but subjectively.

Investment Philosophy of Aditya Birla Pure

Value Fund

|

| Source:Morningstar |

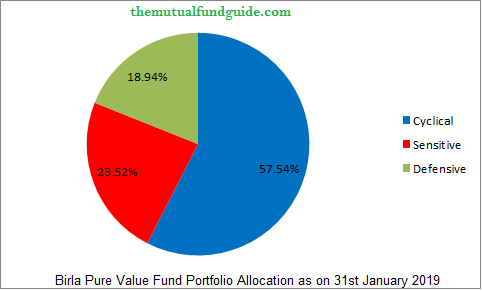

The above picture clearly shows that the allocation of absl pure value fund to

cyclical businesses is far more than compared to other sectors at 57.54 %

What is a cyclical business?

- A cyclical business is one which does not have standard performance throughout the business cycles. When it does well, it does really well but when it does poor, it does really poor. It goes through periods of high revenues to extremely low phases.

- In such an industry the most pivotal point then becomes what is commonly known as the margin of safety. This margin of safety as the very name suggests makes sure there is enough to fall back on in case things go really south.

- Industries that are involved in the production of consumer durables and raw materials can be said to be a cyclical business.

- These industries are very sensitive to even the minute of changes in price, regulations, etc.

What is cyclical investing?

- An economy goes through various cycles. There are periods of high growth and expansion to periods of extreme lows. Cyclical investing basically entails having a keen eye for businesses that show massive potential for growth, albeit this is subjective to its standing in respect to the economy.

- This approach is more applied by traders rather than investors.

- This is because as previously mentioned these stocks tend to be more volatile and sensitive to events and regulations of any kind.

- This approach requires an adept skill set to understand the economy and sectors in general and stocks in specific. As much as it is a risk, when executed efficiently the returns outweigh the risks.

A risk is only a risk when you do not know what you are doing.

As the image suggests, the top two sectors in aditya birla pure value fund are Basic Materials and Consumer Durables.

Now under ‘’ What is a Cyclical Business ‘’ you can find the

two points, so as you can see the portfolio is aligned with its strategy.

Parag Parikh Long Term Equity Fund vs Aditya Birla Sun Life Pure Value

Fund

Investors often compare the two equity funds and depending on what the returns have been lately, pass their judgement as to which is better.

Investors often compare the two equity funds and depending on what the returns have been lately, pass their judgement as to which is better.

Parag Parikh Long Term Equity Fund is no more called the Long Term Value

Fund, it is now the Long Term Equity Fund after SEBI’s re-categorization.

Click Here to read complete review of Parag Parikh Long Term Equity Fund

Click Here to read complete review of Parag Parikh Long Term Equity Fund

- Even though both claim to be a Value Scheme, their definition varies to quite a large extent.

- For example Aditya Birla Pure Value Fund's approach is a more hands on approach as compared to Parag Parikh Long Term Equity Fund which has a buy and hold approach.

- Parag Parikh Long Term Equity Fund bought shares of Amazon in January 2019 which by no means was a beaten down stock.

- Aditya Birla Pure Value Fund on the other hand has a more buy and sell approach. It picks stocks that it feels are undervalued, irrespective of the price of the same. Once it feels the stocks have reached a point where it is valued appropriately it will be eliminated.

- The approach therefore is not to hold and grow but rather to exit when the stocks have reached an appropriate price and look for new ones it feels are undervalued which leads to a high portfolio turnover ratio.

As on February 2019

its turnover ratio was as high as 264 %

- A turnover ratio basically tells you the extent to which your portfolio has been churned. A ratio exceeding 100 would mean the fund manager has changed his portfolio at least once.

- A high turnover ratio is not necessarily a bad thing.

- It is higher for aggressive schemes like mid, small, value and contra and lower for the rest.

- As previously mentioned this absl pure value fund takes a buy and sell approach rather than buy and hold approach. It therefore keeps buying and selling more frequently as compared to other equity funds.

|

The above image signifies the funds returns for the period from 2014 to 2018.

Observations

2014: ABSL Pure Value Fund beats not only its benchmark but also the category

returns by recording almost 100% returns. The difference between its returns

and the returns of the benchmark and category is massive and that is the value

you are getting.

2015-2016: In these years despite the market not having a

great time overall, the fund still manages to beat both the benchmark and the

category returns.

2017: It records returns to the tune of 56 % and beats the

benchmark by 19 % and category by 16 %. The difference between the fund,category and benchmark is again noteworthy.

2018: As you can see, it was not a great year for the fund.

Yes, the benchmark and the category returns are also in the negative but they

have not fallen as much as the fund.

When Aditya Birla Sun Life Pure Value fund has a great year say in 2014 and 2017, not

only does it do well, it also beats the benchmark and category impressively.

This difference is the value you are investing, however when the fund fell in

2018, it did worse than the benchmark and category.

This difference is the risk you signed up for, remember a risk is only a risk when you do

not know what you are doing.

A high risk undertaken with proper research and margin

safety can be highly rewarding, provided you are ready to sail through the

volatility.

|

- SEBI had re-categorized various equity schemes in 2018, so we have therefore reviewed Mid-Cap Funds from 2013 to 2017. There was no separate category for value funds.

- The only fund that comes anywhere near it is the Mirae Asset Emerging Bluechip Fund. This was a Mid Cap Fund before re-categorization but is a Large & Mid Cap Fund now.

- Both HDFC Mid Cap Fund and L&T Mid Cap Fund have performed reasonably well too but in the same period are lagging behind the Aditya Birla Pure Value Fund.

- Of course mere returns should never be the sole criteria for investing, for past returns are no guarantees for future returns but when one compares the AUM of all the above schemes, it comes as no surprise that Pure Value Fund is lagging way behind since the idea of Value Investing when it comes to retail investors seems yet to pick up.

We look at some common queries forwarded to us by our

readers

1) I bought this fund in

June 2018 and sold it in December 2018 at a loss of 5,00,000. Did I pick the

wrong fund, should I redeem from other Birla Funds too?

Never invest in an equity scheme if your time horizon is

less than 5 years. The time period extends in the case of an aggressive mutual fund.

Also make sure a Lump Sum in an aggressive equity fund does not constitute your core

portfolio, it should only be part of your satellite portfolio.

This is one of the basic issues with Equity Investing.

Investors by means of their transactions say they have invested for 8-10 years but by means of their behavior it is often 8-10 months and not years.

2) When I invested it

was a 5 star fund, then it became 4 and now it is 3. My

investments are at a loss of 12%, should I move out and invest in another 5

star fund?

You should never ever

invest in a mutual fund purely on the basis of the ratings or for that matter even high past returns.

- There are so many points to take cognizance before even taking the next step. Often investors pick a mutual fund based on its rating and then keep on shifting funds with the change of ratings, never being able to avail the complete benefits of compounding growth.

- If you have a conservative or moderate risk appetite then no matter how highly an aggressive fund has been rated, they are just not for you.

- Imagine this as trying to put on a shirt that is too small for you but you insist of wearing only because it is in your favourite colour. You will never ever feel comfortable no matter how much you like the colour.

- Equity Investing is a lot like that, more than high returns and ratings what you should be asking is whether it aligns with your risk appetite.

Summary

a) Aditya Birla Sun Life Pure Value Fund is an extremely volatile fund but also a highly rewarding

scheme, only venture into it though if you can sail through the volatility. We

all want high returns at the end of the day but keep in mind that returns is a process and not a

destination.

b) Do not try to time the scheme, if you want to do a Lump

Sum then make sure it is part of your satellite portfolio and not core and do a

STP if possible.

c) ABSL Pure Value Fund has no bias towards any sector but goes

mostly for mid & small cap stocks. On top of that it goes for cyclical

businesses which makes it all the more volatile.

d) If you cannot

handle high volatility then stay away, do not let your ego get the better of

you.

The Fund unfortunately has a pattern where most investor

inflows happen when it is at a high and most outflows take place when the fund

is at a low. This is contradictory to what value investing stands far but not

surprising.

With Mutual Funds in

particular and the Equity Markets in general, there seems to be an overflow of

information but not enough of knowledge and this creates a major communication

gap with what the Fund Manager is trying to achieve and what investors are

expecting.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Disclaimer : While due precaution has been undertaken in the preparation of this article, The Mutual Fund Guide or any of its authors will not be held liable for any investments based on the above article. The above article should not be considered financial advice and has been published only for your perusal. Due credit has been given in case wherever required, in case you feel any part violates any rights then do get in touch with us and we shall get it duly removed.

Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing

Copyright © 2019 The Mutual Fund Guide, All rights reserved.