Investing in Mutual Funds for

your child’s future is no more a choice but has rather become a necessity

considering the following reasons:

> Ability of Mutual Funds to beat inflation over a

long time horizon

> Rising education inflation

> Inability of other investment avenues to beat

inflation in the long run

> Difficulty in coming up with a large amount

together as opposed to accumulating over a period of time

Poor planning has repercussions

that can be felt beyond generations and thereby it is imperative you invest

after carefully considering various factors to avoid the impending disaster.

When you invest in Mutual Funds you usually look at the

category of the funds you have invested in. This gives you an idea as to

whether you possess the risk appetite to invest in the funds or no.

Another reason why this is important is because it helps you

understand how concentrated or over diversified your portfolio is. Either case

is detrimental to long term success.

Click Here to learn further about how to diversify your

mutual fund portfolio.

When it comes to ‘solution’ based funds though, investors

often find themselves deserted while trying to unravel as to what exactly the

strategy of the fund is when it comes to growth and downside protection.

As surprising as this may sound, there’s nothing out of the

box or ‘unique’ about solution funds like children’s mutual funds or retirement

mutual funds.

They are basically hybrid funds (mostly aggressive)

disguised as children or retirement specific.

Which Mutual Fund is best for child education?

This is a very common question going around and will

continue to be so. In order to better understand how to go about this, first

let’s try and analyze what should you not be doing to reach your desired

objective.

Stay away from Mutual Fund schemes that claim to be the one

stop solution for your child’s future. These products are given what

is usually called in the world of advertising as ‘emotional appeal’.

Every parent wants the best for his/her child and thereby is

more likely to invest in something that claims to solve every issue their child

may face in the future.

You invest not on the basis of sound financial judgment but rather on the emotional chords that are being strung involving your child.

Now let’s try and understand why most ‘Children Mutual

Funds’ out there are merely a self-sabotaging exercise using the examples of

various popular mutual funds out there for children.

HDFC Children’s

Gift Fund

Fund Manager: Mr.

Chirag Setalvad & Mr. Amar Kalkundrikar

Category:

Solution

Date of Inception:

2nd March 2001

Benchmark: Nifty

50 Hybrid Composite Debt 65:35 Index

Lock in: Yes, for

5 years

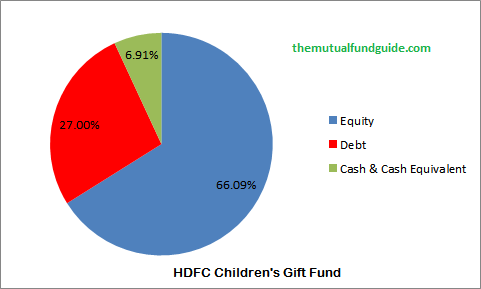

As on 31st August 2019, the fund has the

following bifurcation.

Equity: 66.09%

Debt: 27.00%

Cash & Cash

Equivalent: 6.91%

Now let’s look at another ‘Aggressive Hybrid’ fund from HDFC

Mutual Fund.

HDFC

Equity Hybrid Fund

As on 31st August 2019, the fund has the

following bifurcation.

Equity: 69.66%

Debt: 28.42%

Cash & Cash

Equivalent: 1.92%

Equity

|

Debt

|

|

HDFC Children's Gift Fund

|

66.09%

|

27.00%

|

HDFC Equity Hybrid Fund

|

69.66%

|

28.42%

|

Difference

|

3.57%

|

1.42%

|

Axis

Children’s Gift Fund

Fund Manager: Mr.

Ashish Naik & Mr. R. Sivakumar

Category:

Solution

Date of Inception:

2nd March 2001

Benchmark: Nifty

50 Hybrid Composite Debt 65:35 Index

Lock in: Yes, for

5 years

As on 31st August 2019, the fund has the

following bifurcation.

Equity: 69.06%

Debt: 30.49%

Now let’s look at another ‘Aggressive Hybrid’ fund from Axis

Mutual Fund.

Axis

Equity Hybrid Fund

As on 31st August 2019, the fund has the

following bifurcation.

Equity: 70.59%

Debt: 29.38%

Now let’s try and understand the difference between the two

Equity

|

Debt

|

|

Axis Children's Gift Fund

|

69.06%

|

30.49%

|

Axis Equity Hybrid Fund

|

70.59%

|

29.38%

|

Difference

|

1.53%

|

1.11%

|

As can be seen from the above table, there’s not much to

choose between the two ‘aggressive’ schemes as far as strategy is concerned.

You could have rather merely held onto to the scheme without

any lock in option and could have still availed the same strategy that you

would otherwise with the Children specific fund.

SBI

Magnum Children’s Benefit Fund

Fund Manager: Mr.

Rajeev Radhakrishnan

Category:

Solution

Date of Inception:

21st February 2002

Benchmark: Nifty

50 Hybrid Composite Debt 15:85 Index

Lock in: Yes, for

5 years

This is an interesting fund but for all the wrong reasons as

the image below would magnify.

As can be seen from the image, the fund is more invested in

debt as compared to equity and the reason for the same is because it is a

Conservative Hybrid Fund as opposed to Axis Children’s Gift Fund and HDFC

Children’s Gift Fund which are Aggressive Hybrid Funds.

Why SBI Magnum

Children’s Benefit Fund is a poor deal?

> It has more exposure to debt as compared to

equity

> It is a conservative hybrid fund despite it

being for a long term horizon

> It has a lock in period of 5 years when there

are open ended funds with the same or similar strategy.

The fund falls behind on so many factors that it comes as no

surprise that despite it being launched on 21st February 2002, it

has only been able to accumulate a corpus of Rs. 62 cr as on 31st

August 2019.

The basic idea of investing for your child is to have growth

over a long term period that possesses the ability to beat inflation, if not

then you are merely experimenting with your hard earned money that defies

logic.

Keep in mind that education inflation rises at a much faster

pace as compared to general inflation, so you cannot look at only growth but

rather growth that beats inflation.

There’s no better option to beat inflation in the long run

as equities, this is why having a Conservative Hybrid Fund for such a long term

period makes little to no sense.

Of course, you could always argue it to be a

portion of your overall portfolio but then again it brings up the same point of

having a close ended fund when you can also look for an open ended fund with

the same strategy.

How to

invest in Mutual Funds for your children?

Earlier we read the possible pitfalls to avoid when

investing for your children, now let’s study how to plan investments in Mutual

Funds for your children.

Mutual Funds risk

appetite

This goes without saying but having a plan is paramount and

not following it suicidal.

You would have to factor in the following points when making

a plan:

> Time Horizon

> Amount to invest

> Amount to achieve

> Risk profile etc.

Sticking to pure debt funds or funds that are heavily skewed

towards debt are futile when it comes to beating inflation but even investing

in equity funds has its fair share of challenges.

It’s a common misconception that a longer time horizon (10

years or more) by default would allow you to invest in aggressive funds, it’s

one thing being able to invest in these funds but it is a completely different

thing to be able to go through long periods of market lows being inactive.

You need to be able to strike the

right balance between growth derived from long term equity investing but at the

same time resisting the temptation to redeem when the markets see a correction.

This is personal and not general,

what works for you may not work for your neighbour and so on.

Therefore having a frank and

honest conversation with your adviser is the only way out.

How to

track my mutual fund portfolio?

Now that you have started to invest, the next task to

accomplish is how to review your portfolio.

A couple of pointers regarding the same:

- Do not let short term under-performance let the

alarm bells ringing

- Be on the lookout for any changes in the fund that would directly or indirectly have an impact on your portfolio

These could include any of the following

> Change in fund manager

> Change in category of scheme

> Constant under-performance of the fund over

several quarters when compared to its benchmark.

Keep in mind though that had you invested in any of the so

called ‘Children’ specific schemes as mentioned above, you would not be able to

make any changes since they all come in with a lock in period of 5 years.

When to

redeem your mutual fund investments?

This is probably right up there with some of the most

under-rated points that are rarely or never accounted for when it comes to

mutual fund investing.

Let’s try and understand this with the help of a

hypothetical scenario.

Imagine it’s 2008 and it is the same year you had to redeem

your mutual fund investments since you are left with no choice.

You redeem your investments since that very year you need to

pay fees for your child’s higher education which for obvious reasons cannot be

postponed.

You are left with no choice but to redeem your investments

at a loss, may be even 50% below your invested amount.

In such a scenario, the overall exercise that included

careful planning, regular reviewing, etc. becomes redundant.

So what should you

have done ideally?

When it comes to goal specific investments, make sure you

have studied beforehand how long you will invest, how long you will stay

invested and the mode of investment (lumpsum or SIP or both)

Now whatever the year you would be requiring the money, make

sure you plan it such a manner that you would be redeeming your investments at

least 2 years before.

This would also give you a better picture of the amount you

actually need to invest.

Successful investing in mutual funds is not about never

being in the red, being up or down does not determine the fate of a mutual fund

scheme. What separates the successful investor from the unsuccessful one is the

ability to plan, avoid outside noise and sticking to the plan.

Making money is difficult but making it last trumps that as

far as difficulty is concerned.