Fixed Deposits have historically speaking, been the first

source of investment for most of us and with good reasons as stated below:

- Capital growth

- Capital protection

- Interest as an additional source of income

- Guaranteed returns etc.

Along with the above mentioned points, Fd’s also have a

sense of hereditary touch to it.

Our grandparents endorsed it to our parents and our parents

to us, Fd’s were passed on from one generation to another in the form of a

family heirloom.

Fixed deposits have their obvious benefits but many are

still oblivious to its shortcomings or at least the severity of it.

Liquidity

Fixed deposits are less liquid than most other sources of

investments since they are locked in for a specific time period. You therefore

cannot be dependent on them in case of an emergency, yes they can be cashed in

before the expiry of their term but that would come along with a penalty.

Not suitable for long term goals

Fixed deposits are not suitable for long term goals since

they cannot beat inflation in the long run. All our future goals be it

education expenses, wedding expenses, retirement fund, etc in fact take the

most hit due to inflation rates.

Fd’s cannot outgrow inflation in the long run and therefore

become more of a burden rather than a boon. If the average inflation rates for

all those years is say 6% and your fd’s fetch you say on average 7% then

basically you have only gained 1%.

Timing

The time when you enter into a fixed deposit also plays a

very important role linked directly with the final return. If you enter at a

low rate then the same rate will be fixed throughout the tenure irrespective of the change in rates later on. So even if the interest rate is

increased later on, you would still be on the earlier low rate of interest.

It is a very big misconception that unlike the stock

markets, fixed deposits are not affected by the economy. A stock market is

merely a representation of the general economy, fixed deposit rates are no

different.

If a bank offers you 6% on your fixed deposit, then it would

be lending around 8 to 12% various other loans. The riskier the loan, the

higher the interest rate, case in point is personal loans.

The bank can offer 6% only when it can lend at 8 to 12% and

it can lend at 8 to 12% only when someone can afford those rates and they can

afford those interest rates only when the economy is sound, be it with their

job or business.

In March & April of 2020, the Covid-19 crisis affected

the general economy and thereby the equity markets and the bank rates as well.

Banks

|

Savings

Interest Rates

|

Kotak Mahindra

Bank

|

3.75%

|

State Bank of

India

|

2.75

|

This was the case also with other small saving schemes

Scheme

|

Jan-March 20

rates

|

April-June 20

rates

|

Senior Citizen

Savings Scheme

|

8.6%

|

7.4%

|

National Savings

Certificate

|

7.9%

|

6.8%

|

Public Provident

Fund

|

7.9%

|

7.1%

|

Sukanya Samriddhi

Yojana

|

8.4%

|

7.6%

|

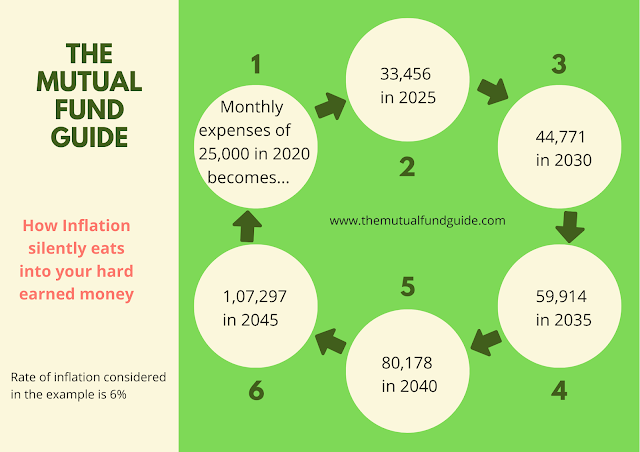

Inflation

This is the biggest disadvantage of fixed deposits that is

very rarely discussed.

Inflation is something that cannot be controlled but can

only be managed. You cannot stop the rains but you can always manage it by

using an umbrella, same is the case with inflation.

Inflation is a silent killer since it eats into you hard

earned money gradually and not in one go. This is precisely why it becomes so

difficult to detect it.

Hypothetically let’s say that a 30 year old is today

spending Rs. 25,000 for his monthly expenses, 30 years when he’s retired at 60

the same 25,000 would then be 1.43 lakhs. This is when we assume the monthly

expenses would be fixed when in fact they would only rise further more so when

you take into account medicinal costs.

Healthcare is a non-discretionary expense, meaning it cannot

be avoided.

Here’s a list of top 5 banks eager to lend to a retiree with

no regular source of income:

1)

2)

3)

4)

5)

Fixed deposits should therefore never be your primary

source, only source nor should it take up a major chunk of your overall

portfolio for long term goals. They cannot beat inflation and therefore erode

your capital too, are not tax efficient and portray a false sense of financial

security.

As it is for many salaried individuals there is a monthly

contribution to their EPF so adding more of fixed deposits and gold to it would

mean diversifying in the same basket.

If you think you are playing it safe by investing in fd’s then

you could not be further away from the truth.

The greatest risk of them all is

not taking any.

You need to therefore figure out a source of investment that

does what fixed deposits cannot or else what’s the point. Something that beats

inflation in the long run, grows your capital and can match your long-term

goals and their inflated prices and not today’s prices (as seen above in the

monthly expenses example).

Why Equity Mutual Funds?

As stated above, you

need to look at an alternate source of investment only if it can cover the

shortcomings of fixed deposits and equity mutual funds certainly tick that box.

At the beginning we had discussed about the various

disadvantages of fixed deposits, now let’s see how these very disadvantages of

fd’s become advantages of equity mutual funds.

Additional reading: Click Here to read more about equity mutual funds.

Liquidity

Equity mutual funds can be redeemed as and when you wish

to, in case you redeem it before the investment completes a year though you would be

charged a 1% exit load. There is no exit load on equity mutual funds that have completed a year.

This rule has been

kept in place to discourage equity investors from viewing the equity markets

from a short-term perspective.

Tax saving equity mutual funds or elss funds come with a

lock in period of 3 years whereas fd’s for tax saving purposes under section

80c of the Income Tax Act come with a lock in period of 5 years.

You therefore

need to stay invested for further two more years in a fixed deposit as compared

to a tax saving elss fund where you will be taxed only on profit exceeding 1

lakh whereas in the tax saving fd, interest earned is taxable and variable

depending on your tax bracket.

Additional reading: Click Here to read more about Tax Saving mutual funds.

Suitable for long term goals

Equity mutual funds are volatile in the short run but stable

in the long run so therefore are more suitable for long term goals. Long term

here would mean for 5 years or more.

Long term goals could include but not limited to future

wedding expenses, higher education expenses, house purchase, etc.

Equity mutual funds and your long-term goals have a lot more

in common as explained below:

- Both are for long term.

- Equity mutual funds beat inflation in the long run and your long-term goals need something that can do exactly the same.

Timing

In case you are investing a lumpsum amount in an equity

mutual fund then you need not invest the entire amount in one go. Therefore you

need not worry about timing your entry, you can do so via a Systematic Transfer

Plan unlike Fixed Deposits where you need to invest the entire amount in one

go.

A Systematic Transfer Plan allows you to invest in a

gradual manner thereby allowing you to average out the ups and downs of the

equity market.

You do not have the same liberty in a fixed deposit.

Time spent in an equity market is more important than timing

the market.

Inflation

You can expect an average of 12% CAGR in equity mutual

funds, given that you are willing to stay invested for 5 years and more.

The average inflation rate that is usually taken for

calculation is 6%, this goes higher for educational and medicinal expenses.

We haven’t considered lifestyle inflation here since that is

more of a discretionary expense.

- Fixed deposits cannot beat inflation in the long run whereas equity mutual funds do so by a high margin.

- If you are worried about volatility in the markets then keep in mind that volatility in equity markets is not a drawback but rather a feature.

- Instead of worrying too much about investing in one go and with a large amount, you can go for either STP or SIP, the benefits of SIP’s are explained below.

Easy Diversification

You can choose from various categories and schemes. In a

fixed deposit you would choose to diversify within 2-3 banks but with mutual

funds you can pick from more than 40 amc’s and within those mutual fund

companies too, you have your choice of categories to invest in.

No need to time the market

There is no need for you to time the market. Your SIP would

be deducted on a fixed date every month thereby not needing you to see and

analyse the markets before investing. This also inculcates a sense of

discipline in your financial planning.

It’s Convenient

You can start, pause and stop your SIP’s online itself. You

can also stop them as and when you wish to. Except for tax saving elss funds,

there is no lock in period for other equity funds. Even when you stop your

SIP’s, you can still let the already accumulated investments stay invested.

Long Term Benefits

SIP’s have long term benefits because you can start off with

a small amount, like say 5,000. Over a period of time you can therefore

accumulate a large corpus. This is possible due to the power of compounding.

With rising inflation, equity mutual funds and SIP’s in them

can also help you beat inflation to meet your long-term goals.

- Fixed Deposit in itself is not a bad source of investment but it is a terrible choice for long term investment.

- This does not mean that they should not be a part of your overall portfolio, they should, but not the only or primary source of investment for your long-term goals. This is how asset allocation works.

- Inflation is something that has always been discussed but very rarely are solutions provided to overcome the same.

- You need not to invest in pure equity funds at the start itself, you can begin with more conservative categories like equity savings fund, balanced advantaged funds, hybrid aggressive funds, etc.

- Same can be said about the amount too, you can begin with 5,000 or 10,000 until you get more comfortable. The important point is that you begin somewhere.

It is indeed a state of affairs when only around 2-3% of the

overall population of our country is investing in the equity markets when you

have the FII’s lapping up as much as they can to take advantage of our growing

economy.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Disclaimer : While due precaution has been undertaken in the preparation of this article, The Mutual Fund Guide or any of its authors will not be held liable for any investments based on the above article. The above article should not be considered financial advice and has been published only for your perusal. Due credit has been given in case wherever required, in case you feel any part violates any rights then do get in touch with us and we shall get it duly removed.

Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing

Copyright © 2020 The Mutual Fund Guide, All rights reserved.