HDFC Midcap Opportunities Fund

Fund Manager: Mr Chirag Setalvad

Category: Mid Cap

Date of Inception: 25 June 2007

Benchmark: Nifty Midcap 100 TRI

What is HDFC Mid Cap Fund?

- HDFC mid cap fund is a mutual fund scheme that invests primarily into mid-cap stocks as classified by SEBI rules.

- SEBI rules state that companies between 101 and 250 in terms of full market capitalization can be classified as Mid cap companies.

- A mutual fund scheme to be classified as a mid cap scheme needs to invest a minimum of 65% into mid cap stocks whereas the rest can be decided by the fund manager.

- HDFC midcap opportunities fund was earlier known as HDFC small and mid-cap fund.

HDFC Midcap Opportunities Fund portfolio

HDFC Midcap Opportunities Fund is one of the most aggressive mid cap mutual fund schemes which is why it also has a poor track record in protecting gains during a low market phase.

This is

because hdfc mid cap fund either takes a higher allocation to mid cap stocks,

i.e. more than the mandatory scheme allocation of 65% or takes the surplus

allocation into small cap stocks.

The mid cap

fund also mostly takes a higher allocation on its top stocks as can

be seen by the table below:

|

Number of Scrips |

74 |

|

Top 10 scrips allocation |

32.44% |

|

Other scrips allocation |

67.56% |

- HDFC Midcap Opportunities Fund therefore is heavily dependent on its top stocks, this becomes an even more sensitive point when you consider its high AUM.

- 64 scrips make up the rest of the 67.56% of HDFC Midcap Opportunities Fund, thereby the rest of the scrips individually make up around 1% of the HDFC mid cap fund.

- The high aum of hdfc midcap opportunities also works to its disadvantage because SEBI rules dictates that a minimum of 65% in a mid cap fund has to be invested into mid cap stocks.

- This mid cap mutual fund also takes more allocation to mid & small cap stocks in the discretionary 35% of the portfolio.

Click Here to read how to diversify your Mutual Fund Portfolio

When a

mutual fund has a high aum then sooner or later it will struggle with liquidity but this is even more concerning for mutual funds with aggressive

stocks and portfolios.

This also

explains why many mid and small cap mutual funds like Mirae Asset Emerging

Bluechip Fund, SBI Small Cap Fund, DSP Small Cap Fund had in the past

restricted inflows.

So it is quite surprising that HDFC Midcap Opportunities Fund has neither restricted inflows nor are there any signs that it might do so in the future.

In the past, various events worldwide as mentioned below have had their negative effects on funds with a huge size AUM:

- Mexican Peso Crisis

- Asian Crisis of 1997

- Lehman Crisis 2008 (Global Financial Crisis)

HDFC Midcap

Opportunities Fund also has a higher exposure to sectors that can be seen as

more volatile and vulnerable to market sentiments.

|

| As on 30/04/2020 |

In defense of the hdfc mid cap fund, an aggressive mutual fund has to occasionally if not always look at aggressive bets to create alpha but a fair criticism can also be attributed to the fact that other mid cap mutual fund schemes have been able to generate similar or even better returns at times, with a lower risk outreach along with providing a better downside protection.

How good

is HDFC Midcap Opportunities Fund?

- HDFC Midcap Opportunities Fund prior to SEBI’s recategorization was known as HDFC small and mid cap fund.

- Historically speaking therefore, HDFC mid cap fund has always been one of the most aggressive mutual fund schemes.

- The fund in its initial years did find itself isolated at the top but slowly and gradually this mid cap fund has found itself surrounded by other mid cap funds that have excelled during both a bull run as well as bear phases.

- No one mutual fund scheme can remain at the top constantly and if it does then serious questions need to be asked of the category in question.

In 2014

which was a fantastic year for mid and small cap mutual funds, HDFC Midcap Opportunities Fund only merely made it to the top 10

list.

Keep in

mind that this is only for mid cap mutual fund schemes and not

the mutual fund universe as a whole.

In 2018

which was not a fantastic year for mid and small cap mutual funds, HDFC Midcap Opportunities Fund again only merely made it

to the top 10 list.

This

therefore then raises the obvious question as to what exactly is the purpose of

hdfc mid cap fund.

The answer to that lies in understanding the finer details in how this mid cap fund functions:

- HDFC mid cap fund takes more contrarian bets as compared to other mid cap mutual fund schemes.

- It also has a higher allocation to its top 10 scrips along with volatile sectors.

- This mid cap fund is not driven by short term news and views and thereby you will notice irregular positive and negative returns as compared to other mid cap mutual fund schemes.

The diagram below should explain this better

|

| As on 30/04/2020 |

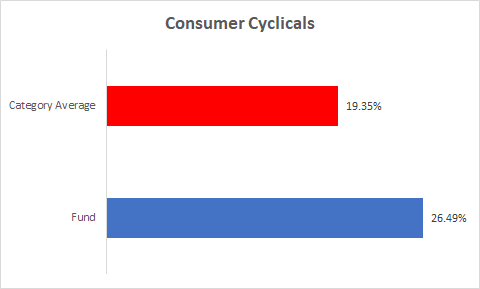

HDFC Midcap Opportunities Fund is overweight in Consumer Cyclicals, as compared to other mid cap mutual fund schemes. Consumer Cyclicals as a sector in itself is considered very volatile.

|

| As on 30/04/2020 |

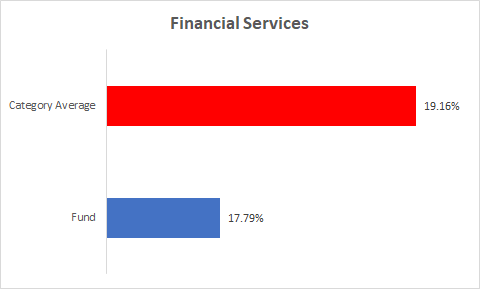

In this case, HDFC Midcap Opportunities Fund is underweight

in Financial Services as compared to other mid cap mutual fund schemes.

Financial Services as a sector is considered more stable.

It therefore is unwise to compare HDFC mid cap fund with

other mid cap funds since this mid cap fund has a style of its own, now whether

this unique style is worth the risk and reward is a very personal choice.

Which Mid Cap Fund is best?

Depending on variable factors like

- Fund size

- Fund Manager

- Fund house strategy

- Fund manager strategy

- Downside protection etc.

The answer to the above query would have to consider all

the above points and you will still need to focus on analyzing where the fund

fits into your overall mutual fund portfolio.

Along with this you would need to constantly review the

chosen mid cap fund to see whether it is still aligned with your goal that you

had set out to achieve.

Should I invest in mid cap funds?

No if:

You do not have a minimum time horizon of 7 years because mid cap mutual funds need to go through cycles including both correction phases as well as growth phases where some mid cap companies may even eventually become large cap companies.

You do not have an aggressive risk profile.

Click Here to read how to check your risk profile

You are likely to be affected by short term volatility in

your mutual fund portfolio

Yes if:

You have a minimum time horizon of 7 years, the longer the

better.

Your mutual fund portfolio allows you take an aggressive

proportion.

The aggressive portion of your mutual fund portfolio does

not exceed 15 % of your overall mutual fund portfolio.

Do not invest in a mid cap mutual fund scheme only because

you feel you need a mutual fund scheme from the mid cap category, because

someone else does or due to high returns that are promised by such aggressive

funds.

You should invest in a mid cap mutual fund scheme by looking

at their returns during a market downtime or bear phase and ask yourself

whether you would have invested during such phases because anyone can stay

invested during a bull phase.

Return of capital is as important as return on capital.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com