|

Fund |

Motilal Oswal

multicap 35 Fund |

|

Category |

Flexi cap |

|

AUM (Rs Cr) |

12,000 (As on 31/12/2020) |

|

Fund Manager |

Mr Akash

Singhania |

|

Benchmark |

Nifty 500 TRI |

How is

Motilal Oswal multicap 35 fund?

Motilal Oswal multicap 35 fund is a flexi cap fund that can

invest in a maximum of 35 stocks.

It needs to be invested 65% into equities and equity related

instruments at all times.

It can invest up to 10% of its portfolio into foreign

securities.

The fund was previously a multicap fund but since January

2021 has been recategorized to the flexi cap category.

It is the only focused fund presently that invests in more

than 30 stocks since most focused funds usually invest in 30 stocks or fewer,

as can be seen below:

- Axis Focused 25 fund

- Principal Focused fund (30 stocks)

- SBI Focused Equity (30 stocks)

What

is a flexi cap fund?

A flexi cap fund is one which needs to stay invested into

equity for a minimum of 65% at all times.

The remaining 35% can be invested in debt, cash, domestic or

international equity.

There is no restriction with regards to cap.

A flexi cap mutual fund is the most flexible mutual fund

scheme since it does not have too many restrictions.

At the same time the role of a fund manager is of prime

importance in a flexi cap fund due to the freedom she gets to run the portfolio.

Any mutual fund scheme that wants to qualify as an equity

fund for tax purposes needs to invest a minimum of 65% into equities at all

times except for elss mutual funds which needs to invest a minimum of 80% into

equities at all times.

Difference

between Focused funds and Flexi cap funds

Some view focused funds as flexi cap funds whereas others do

not.

In reality though, in terms of functioning both types of

mutual funds are same except for one key difference.

A focused mutual fund can invest only up to a certain number

of stocks unlike a flexi cap mutual fund which has no such restriction.

Some focused funds invest up to 30 stocks, some 25 and some

even fewer but they cannot exceed the pre mentioned number of stocks.

There is no restriction with regards to the caps though, the

only restriction is with regards to the number of companies a portfolio can

hold.

A flexi cap fund can function as a focused fund but a

focused fund cannot function like a flexi cap fund.

Investment strategy of Motilal Oswal Multicap 35

Since this is a focused fund, the bets are concentrated and so are the risks.

Most focused funds tend to be large cap biased with a growth

based investing strategy.

Motilal Oswal multicap 35 fund is more value driven even

though it swings between large caps and mid caps frequently.

It has a more momentum driven strategy applied to its

portfolio.

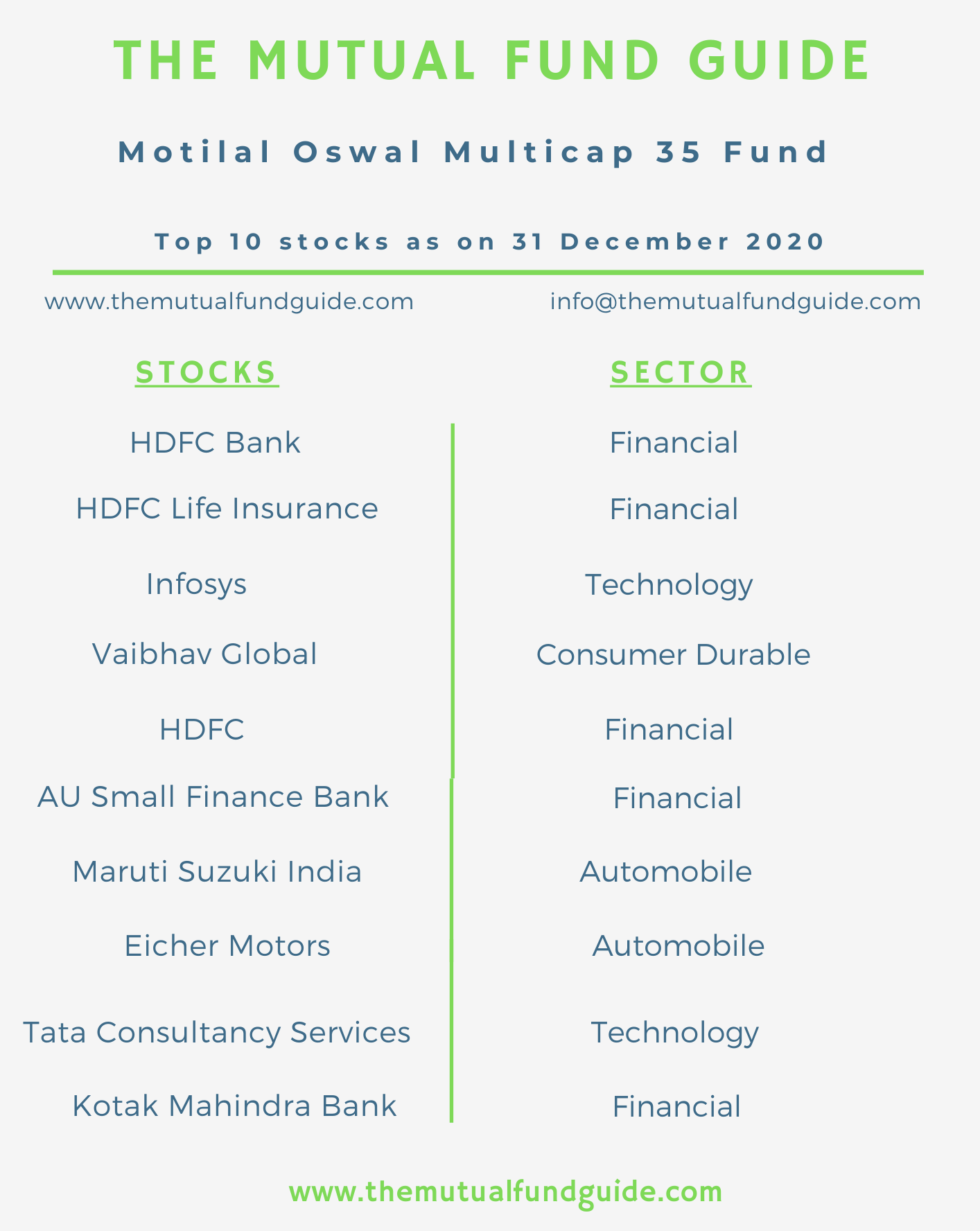

Motilal Oswal multicap 35 fund portfolio

The fund is overweight on financials as compared to the category.

Within financials too all its bets are on private companies

with no exposure to any PSU bank.

It is underweight on chemicals, energy and healthcare

sectors by a big margin.

This should not come as a surprise considering the past

investing trends of this fund.

The fund is more of a value and momentum driven focused fund

which is a unique strategy in the focused fund space.

As on 31st December 2020, the top 10 stocks in

the fund made up 56% of the total portfolio.

This means more than half of the overall portfolio is

invested only in ten stocks.

This makes for concentrated risks.

The fund therefore has a tendency to be extremely volatile

with periods of severe underperformance.

This is to be expected since the fund takes concentrated risks

and bets even in mid and small cap stocks.

For example as on 31st December 2020, it held

5.9% in Vaibhav Global Limited and 4.8% in AU Small Finance Bank Limited.

Should

you invest in Motilal Oswal multicap 35 fund?

Even though the fund has been projected as a Buy Right and

Sit Tight fund, in fact so are all the schemes of the fund house but in reality

though the fund is more momentum driven.

This can be easily ascertained by its high turnover ratio

which is very surprising given its focus on Buy Right and Sit Tight philosophy

so to speak.

Its severe underperformance during certain periods makes you

question whether the risk associated with such an investing style is worth it.

Even if it does make gains in the future, it still has a lot

of ground to catch up to make parity, let alone making a profit.

As an investor you need to ask yourself, when there are

other flexi cap/focused funds with a much more simpler and effective approach

is Motilal Oswal multicap 35 fund worth the hype?

Explaining

the recent underperformance in Motilal Oswal Multicap 35

The underperformance of the fund has coincided with the exit

of Gautam Sinha Roy as its fund manager in May 2019.

Because of its focused approach along with a higher exposure

to the top 10 holdings makes for concentrated risks and bets.

Its top 10 holdings often include even mid and small cap

stocks unlike other flexi cap and focused funds.

In the recent past it has often gone wrong with its

concentrated bets like Vakrangee and Manpasand Beverages.

Every mutual fund scheme will have sectors and stocks it has

high bets but with a focused fund these bets become more risk prone than

rewarding.

This is because a focused fund can invest only in a limited

number of stocks and therefore the allocation to these bets is also on the

higher side and if things go wrong then the effect of the same is also very

difficult to overcome.

As an investor you therefore need to ascertain whether the

risk is worth it.

Most investors often tend to invest in a particular fund

when its recent performance is on the up and redeem when the performance goes

down.

This can be easily inferred by the fall in its AUM in the

last quarter of 2020 when the market was at peak but the fund was underperforming

and therefore investors shifted to other funds.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com