On the 23rd of April 2020, Franklin Templeton

Mutual Fund had declared the closure of its following six debt schemes:

- Franklin India Low Duration Fund

- Franklin India Dynamic Accrual Fund

- Franklin India Credit Risk Fund

- Franklin India Short Term Income Fund

- Franklin India Ultra Short Bond Fund

- Franklin India Income Opportunities Fund

At the time of closure, all these funds together had an

estimated Rs 25,000 crore as assets under management.

Franklin Templeton Mutual Fund had cited illiquidity and

redemption pressures on account of lockdown measures due to Covid as the reason

for closure of the debt funds.

On

investigation, SEBI has found Franklin Templeton Mutual Fund in violation of:

Scheme categorization (by replicating high- risk strategy

across several schemes).

Calculation of Macaulay duration (to push long term papers

into short duration schemes).

Non – exercise of exit options in the face of emerging

liquidity crisis.

Securities valuation practices and

Risk management practices and investment related due

diligence.

Accordingly,

SEBI has imposed the following punitive actions on Franklin Templeton Mutual

Fund:

Franklin Templeton has been barred from launching any new

debt schemes for 2 years.

It has also been fined a sum to the tune of Rs 5 crore.

The fine will have to be paid within 45 days.

Franklin Templeton will also have to refund all management

fees charged from 4th June 2018 to 23rd April 2020 along

with a simple annual interest of 12% from the date of order.

This amount of Rs 451 crore (512.5 crore after interest)

will be utilized to repay the unit holder according to the order.

This amount will have to be paid within 12 days from the

date of order.

“The findings in the instant proceedings have brought on record several irregularities in the running of the debt schemes inspected, contrary to the interests of the unitholders in such schemes. As brought out above, the irregularities also extend to failures to exercise adequate due diligence, carry out valuation of securities as per the principles of fair valuations and ensure a robust risk management framework,”

-SEBI

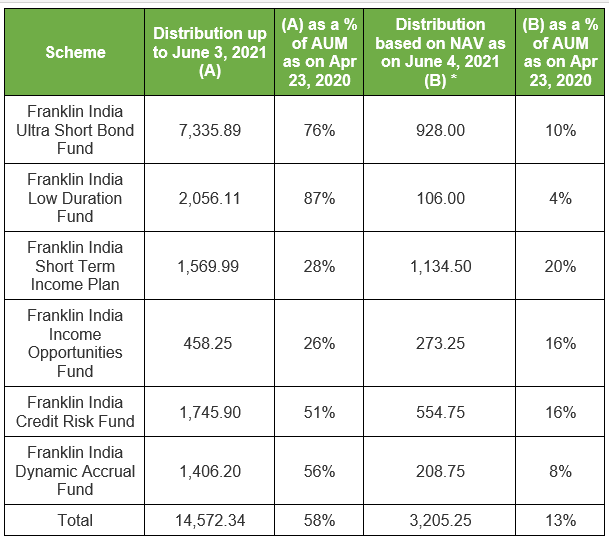

Distribution summary for the six schemes under

winding up – as of June 4, 2021 (Rs. Cr.)

|

Distribution based on NAV as on February 12, 2021 |

9,121.59 |

|

Distribution based on NAV as on April 9, 2021 |

2,962.00 |

|

Distribution based on NAV as on April 30, 2021 |

2,488.75 |

|

Distribution up to June 3, 2021 (A) |

14,572.34 |

|

Distribution based on NAV as on June 4, 2021 (B) |

3,205.25 |

|

Total Cash Distributed (C) = (A) + (B) |

17,777.59 |

"The six schemes under winding up have distributed INR 14,572 crores to unitholders as of April 30, 2021 and an amount of INR 3,205 crores is available for distribution as of June 4, 2021. After this distribution in the first week of June 2021, the total amount disbursed will range between 40% and 92% of AUM as of April 23, 2020 across the six schemes. Including the amounts available as of June 4, 2021 for distribution, 71% of the AUM as of April 23, 2020 will have been returned to unitholders in total across all the schemes. The current net asset value of each of the six schemes is higher than it was on April 23, 2020. We believe this supports the decision made by the Trustee in consultation with the AMC and its investment management team to wind up the six schemes. The schemes have followed a consistent strategy of investing in credits across the rating spectrum and have delivered meaningful outcomes to investors over long periods of time."

- Franklin Templeton Spokesperson

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2021 The Mutual Fund Guide, All rights reserved