On an average, Indians start earning when they turn 26.

The period from when you begin to start earning till when

you finally stop earning via salary or income is called the accumulation stage.

When your monthly income/salary ceases, it is called the distribution

stage.

This does not imply that there are no expenses at all during

your accumulation stage, you do but it is easier to pay off these expenses when

you have an ongoing monthly source of income/salary than when you do not.

Rising longevity & inflation coupled with the absence of

any form of social security like the west makes the need for a retirement fund

a necessity rather than an afterthought.

Why you need a

retirement fund?

When you retire, you stop working but don’t stop living.

Your monthly expenses will continue as they were, in fact

taking into account inflation, it will only grow further.

Further when you consider rising medical inflation &

expenses & growing life expectancy, a retirement fund should be your

primary goal when investing if not a goal you prioritize.

You are going to grow old, it is not a voluntary choice.

Additional reading: Click Here to read about mutual fund mistakes you should avoid making

Inflation

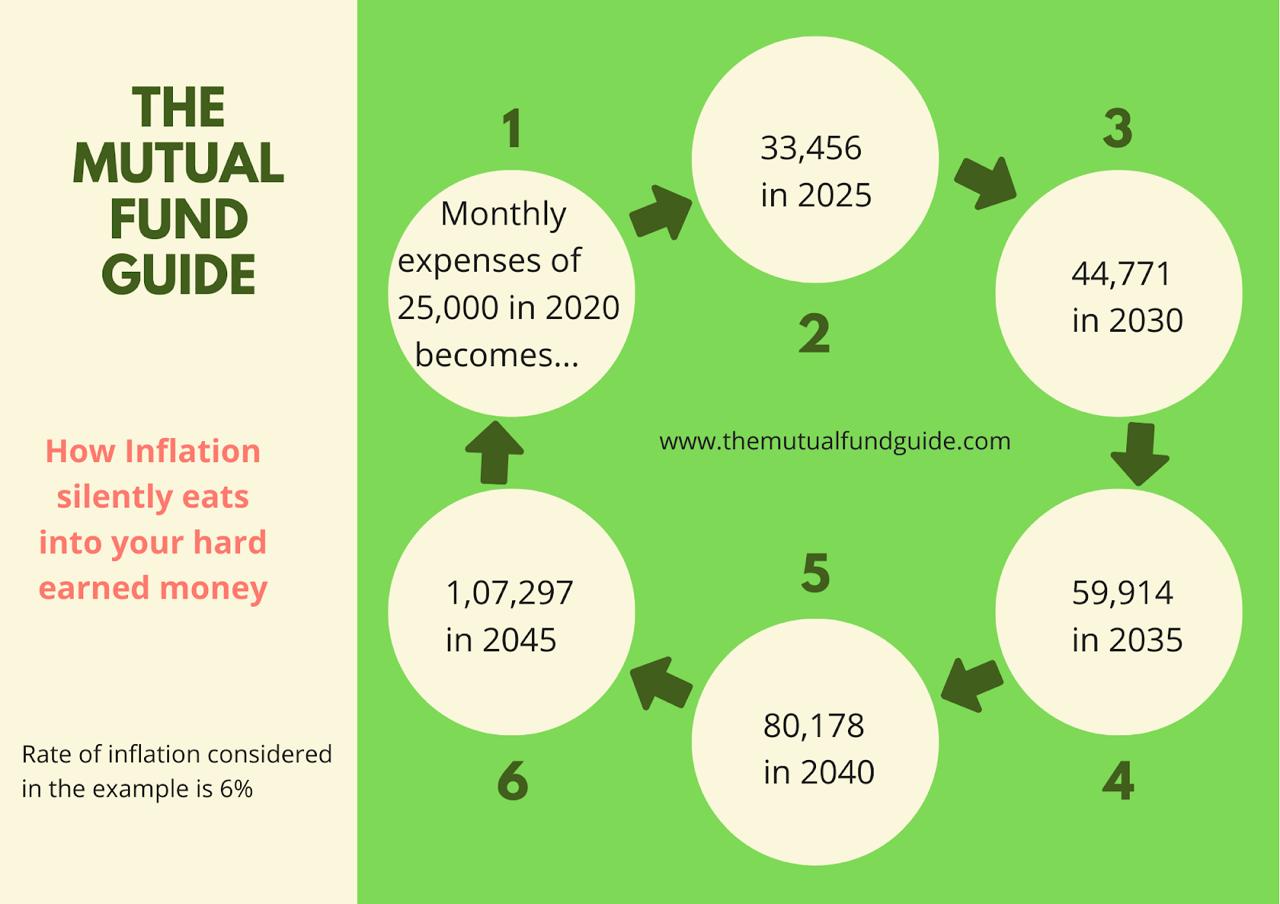

Inflation is something that cannot be controlled but can

only be managed. You cannot stop the rains but you can always manage it by

using an umbrella, same is the case with inflation.

Inflation is a silent killer since it eats into you hard

earned money gradually and not in one go. This is precisely why it becomes so

difficult to detect it.

Hypothetically let’s say that a 30 year old is today spending Rs. 25,000 for his monthly expenses, 30 years when he’s retired at 60 the same 25,000 would then be 1.43 lakhs.

This is when we assume the monthly

expenses would be fixed when in fact they would only rise further more so when

you take into account medical costs.

Healthcare is a non-discretionary expense, meaning it cannot

be avoided.

Insufficient options

Picking the right asset class that can outperform inflation

in the long run is of paramount necessity.

If not then the growth in the value of your money is

negligible or in certain cases even negative.

In a developing economy interest rates are usually high but

so is inflation thereby making high interest rates a moot point since inflation

is also high.

Traditional savings options like fixed deposits and other

small saving schemes are not a healthy option and inflation beating option in

the long run.

Saving is not the same as investing.

|

Scheme |

Jan-March 20

rates |

April-June 20

rates |

|

Senior Citizen Savings Scheme |

8.6% |

7.4% |

|

National Savings Certificate |

7.9% |

6.8% |

|

Public Provident Fund |

7.9% |

7.1% |

|

Sukanya Samriddhi Yojana |

8.4% |

7.6% |

For long term goals, you need an investment instrument that

beats inflation.

Alternate option

Usually when you do not plan well or do not plan at all for

a life goal like say a vacation or a house or your child’s higher education,

you end up taking a loan.

The monthly emi’s eat into your savings and thereby

drastically affect your overall financial situation.

It’s not a great place to be in but nonetheless the option

exists.

You do not have that option with your retirement goal

though.

Here’s a list of top 5 banks eager to lend to a retiree with

no regular source of income:

1)

2)

3)

4)

5)

How to save for a retirement fund?

Start early

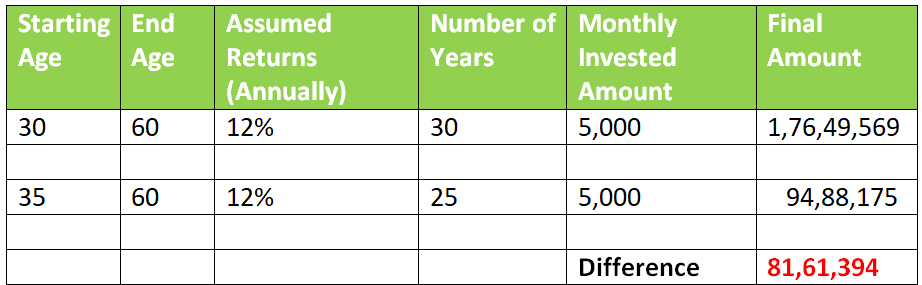

The earlier you start investing, the better it is.

There are many advantages to starting early.

The earlier you start, you have a longer time horizon to achieve your goal.

This also means you can begin with a small amount and compounding has a much bigger impact.

The above table clearly shows that delaying your investment by merely 5 years almost halves your final amount.

This is the cost you pay for delaying your investment.

Remember, you cannot outpace or recover time.

Do not be bogged down by the big numbers initially, start early and stay disciplined.

Annual raise

Most salaried individuals get an annual raise, this is more of a norm rather than set in stone.

The sensible thing to do here would be to increase your monthly investment with a raise in your salary.

It does not need to be the complete surplus raise but a substantial portion of it.

Raising your monthly investment on an annual basis helps you be more flexible with your overall financial goals and not just your retirement goal.

Additional reading: Click Here to read about how to build a mutual fund portfolio.

Having a plan

This seems like such a basic rule to follow but sadly the reality is quite different.

Having a plan would involve various factors from your personal financial situation, flow of income to an emergency fund in place.

Not adhering to one can have a negative effect to a point from which it would be quite exhausting to recover from in every sense and not just financially.

Imagine having to dip into your retirement corpus because you did not plan for an emergency fund beforehand.

Or you were not disciplined enough that you could not resist from making an impulse purchase that has an adverse effect on your retirement.

All other factors like the choice of mutual fund schemes, their performance, etc. becomes secondary.

Periodic Review

The old adage ‘Invest & Forget’ only works if your mutual fund portfolio is being reviewed periodically.

Reviewing your mutual fund portfolio is important due to the following reasons:

- Merger of schemes

- Underperformance of any scheme for a long stretch of time.

- Change in one’s personal financial situation.

- Re-categorization of schemes

- Changes to your scheme (capping on SIP amount)

Use SWP

A systematic withdrawal plan in a mutual fund is a plan which allows you to withdraw a specific amount at regular intervals.

A systematic withdrawal plan in a mutual fund is somewhat the opposite of a sip plan, in a sip plan you can invest on a monthly basis whereas in a systematic withdrawal plan you can withdraw on a monthly basis.

In a systematic withdrawal plan you first need to either make a lumpsum or do a sip plan for as long as possible.

Let the lumpsum amount or accumulated sip investment amount stay invested for as long as possible.

Once the invested amount grows to a certain figure you can make monthly withdrawals.

This makes sure you do not need to time the market and also works as a cushion against market volatility.

Quick Points

- Keep a separate emergency corpus

- Delve into your retirement fund only when you have exhausted all other sources

- Increase your investments as your income grows

- Save and invest your bonuses instead of splurging them on impulsive purchases

It is a bitter pill to swallow but there is no guarantee that your children will spend your retirement years with you. Chances are some may travel for work while some may settle abroad.

The concept of nuclear families is also picking

up in India so do not feel guilty or uncomfortable for investing towards your

retirement. There is no shame in wishing to live your retirement without having

to worry about your finances.

With medical advancements we tend to live longer so the length of your retirement also has to be given due consideration.

Medical expenses are also

on the rise so it is better to plan taking into account a lengthier retirement

life so as to avoid living frugally.

Remember

that you retire from working but not actually living so expenses will continue

to stay.

What

unfortunately will not is a monthly income as was the case when you were

working. To make sure that does not create havoc it is imperative it was taken

care of well in advance.

Remember there are no retirement loans and your children are not your retirement fund.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com