One of the biggest advantages of investing in Mutual Funds

as opposed to other sources of savings and investments is the liquidity it

offers.

To add to that, these days redemption can be executed online

too.

So in order to check how long it would take for the

redemption amount to be deposited in your registered bank account, SEBI had

mandated all the fund houses to make their mid and small cap funds to undergo

mutual fund stress tests.

A stress test would basically determine in how many days you

(investor) can receive your redemption amount in the event of a market

instability.

These tests were in relation to mid and small cap funds.

A market instability could be due to various reasons like

the outbreak of something like Covid, war, etc.

These tests would basically deduce in how many days the fund

manager can sell from 25 to 50% of the fund corpus in the event of a redemption

pressure from investors due to market instability.

Why the need for a Mutual Fund stress test arose?

The regulator is concerned with the unprecedented inflows in

the mid and small cap segment which has been influenced in many ways due to the

outstanding performance in these two segments in the recent past.

Mid and small cap funds with a huge aum often struggle with

portfolio liquidity and would therefore struggle to sell off their portfolios

in the event of a market crash that can be caused due to various reasons.

Comparatively large cap funds or funds with a higher

allocation towards large cap stocks would find it easier to do the same.

Do keep in mind that post the re-categorization exercise in

2018, mid and small cap funds have to allocate a minimum 65% of their

portfolios towards mid and small cap stocks respectively.

The recent surge in both the returns as well as the flows

has led to valuation concerns.

Checking a fund’s liquidity is important because it can show

how promptly a fund can liquidate and handover the proceeds to the investors in

the event a majority of investors redeem simultaneously when the market is on

the downswing.

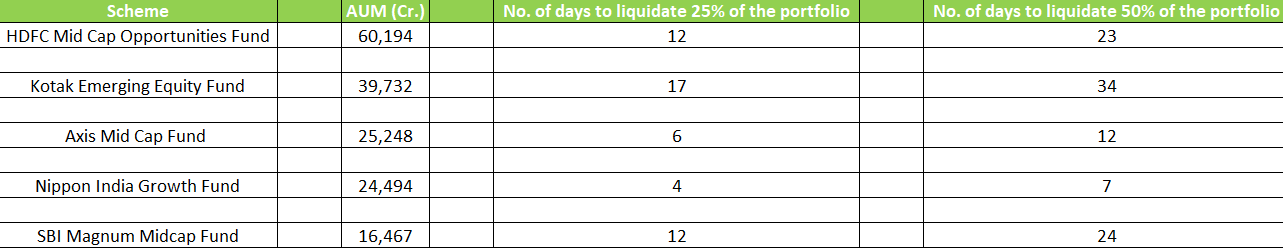

Result of Mutual Fund stress test

Understanding the result

Let’s understand the result by using the example of HDFC Mid

Cap Opportunities Fund

12 days to liquidate 25% of the portfolio : What

this implies is that in case the fund is in a position where it needs to

liquidate and convert to cash 25% of its portfolio and payback in redemption,

it would take around 12 days to do the same.

23 days to liquidate 50 % of the portfolio : What

this implies is that in case the fund is in a position where it needs to

liquidate and convert to cash 50% of its portfolio and payback in redemption,

it would take around 23 days to do the same.

The need for liquidity and in such volume and short notice

could arise due to negative market conditions.

Your role as an investor

Irrespective of the stress results, if you are a long term

investor then you have no reason to worry and continue to stick with your

goals.

Irrespective of the stress results, if you are unsure of

your holding capabilities and time period then you might need to review your

mid and small cap investments.

Always keep in mind that investing in mid and small cap

funds should not be encouraged by your desire of gains but rather your ability

to withstand volatility.

A simple test to check this would be to ask yourself,

‘’Would you stay invested in your mid/small cap fund if say it is down by 50%?

“

If the answer is no then you should seriously consider your

risk appetite to invest in mid & small cap mutual funds.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Copyright © 2024 The Mutual Fund Guide, All rights reserved