Inflation is the sustained increase in prices of goods &

services which in turn reduces your purchasing power since the value of your

money also erodes.

Inflation is not always perceived negatively, a moderate

level of inflation is a sign of a healthy economy since it encourages you to

spend & invest rather than let your hard earned money lose value by letting

it lying around.

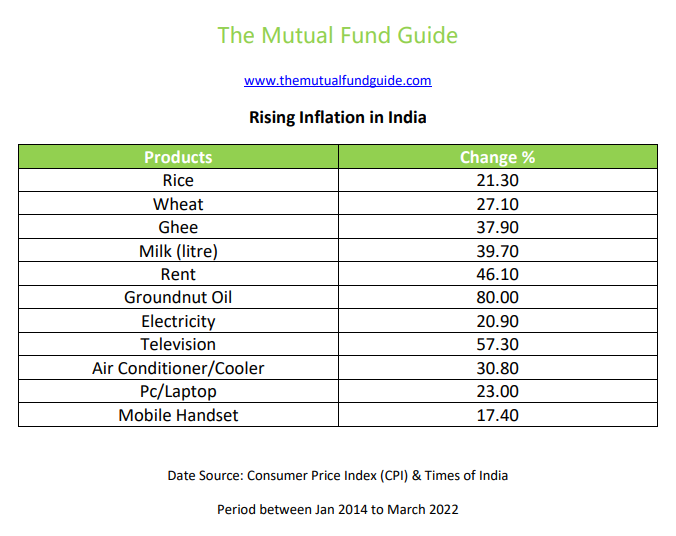

Inflation is not about today, tomorrow or the year after but about its effects over a period of time which can only be described as destructive. It increases the cost of living thereby effectively also reducing your purchasing power.

What causes Inflation?

Inflation could be caused by temporary actions or permanent

ones, man-made actions or natural consequences. There’s no one specific reason

as such.

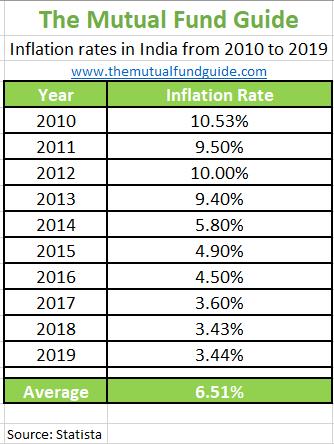

Inflation is seen to be on the higher side for

under-developed & developing economies & on the lower side for

developed economies.

Economic development leads to higher employment leading to more

circulation of money which in turn leads to increase in prices.

Shortage of grapes or for that matter any fruit due to

insufficient rainfall during a particular year will lead to their shortfall which

in turn will lead to higher prices.

Poor economic policies like the one Germany undertook in the

1920’s or Venezuela in the early years of this century are prime examples.

Inflation is taxation without legislation – Milton Friedman

Fixed Deposits & Savings

Suppose you have 10000 Rs in a Fixed Deposit fetching you 5%

interest rate, after a year you will have 10,500. Now let’s say rate of running

inflation is 7%, that would mean you need 10,700 to stay just on par. Forget

about growing under such circumstances.

Even though you believe you have gained 500 but in reality

you have lost 200 since your money could not keep up with the inflation

rate.

Your hard earned money loses value which in turn reduces

your purchasing power, the gap between your money and the inflation rate keeps

on widening.

This is the case with a savings account too.

This is not meant to discourage you from savings at all but

rather set straight the ‘belief’ that you are ‘investing’ in a fixed deposit.

You do not ‘invest’ in a fixed deposit, you save in a fixed deposit therefore

you cannot plan your long term goals using fixed deposits.

A fixed deposit and a savings account should be your primary

source of emergency fund which should be added to from time to time in order to

keep up with rising inflation. The point of an emergency fund is not returns

but rather easy accessibility and suitability for short term durations.

The road to hell is paved with good intentions so do not

fall into the trap of justifying poor actions by good intentions.

Small Savings Fixed Income Products

Small savings fixed income products include

- Small Savings Certificate

- National Pension Scheme

- Sukanya Samriddhi Account

- PPF etc.

Even though these are fixed income products, they are prone

to periodic rate changes.

The rates more or less hover around the inflation mark

therefore they cannot generate inflation beating returns on a consistent basis

in the long run.

These products can be used to a certain extent for long term

goals and be a part of an investment portfolio but cannot and should not be the

sole source.

They have a longer lock in period and thereby are also less

liquid.

Why Equity Mutual Funds?

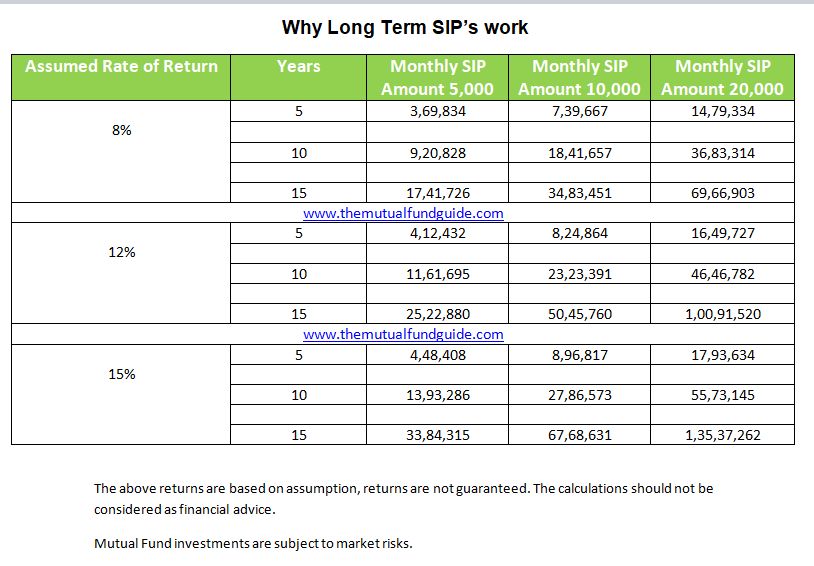

Equity mutual funds have the ability to beat inflation in

the long run.

Returns

Equity mutual funds fetch a high real rate of returns

compared to other traditional savings & investment options.

This means it not only keeps pace with inflation but also is

able to beat it in the long run.

Even though the returns can be volatile in the short term,

in the long run it more than makes up for its volatility.

Equity is risky but inflation is riskier, choose your risk wisely.

Taxation

An equity mutual fund is taxed 10% Long Term Capital Gains

(LTCG) on profits over and above 1 lakhs.

This tax rate will be the same for everyone irrespective of

the tax slab.

This is on the lower side compared to other traditional

savings & investment options.

Now for someone who falls in the 30% tax slab, the interest

gained on a fixed deposit and savings account will be added to the total income

and thereby taxed at 30%.

Therefore higher your income, higher your tax slab and

thereby you end up paying more taxes.

This in turn reduces your real returns.

Even though certain small savings fixed income products have

no taxes, the real returns are way lower so thereby not having to pay taxes

does not translate into real benefits.

Long Term Goals

The value of any long term goal will not be the same when

the time comes as it is today.

For example, your child’s higher education fees after 10

years is not going to be the same as it is today.

So you cannot ‘save’ as per the fees today but would need to

rather ‘invest’ as per the fees after 10 years.

This is the case with other long term goals like purchasing

a house, retirement, etc.

In the long run, your money loses value therefore it is

important that your money is invested in products that beat inflation

handsomely.

For certain goals like the higher education fees, you cannot

postpone the goal.

Availing a loan when you could have saved & invested

puts both generations in a soup.

Retirement

We are all going to retire from working someday, it’s not a

choice as such.

When you retire, you retire from working and not actually

living and as long as you are alive, there will be expenses.

Often retirement is at the bottom of financial goals and

most of the times it is not considered a life goal at all.

This could be attributed to our cultural mindset in thinking

pension would be enough or kids will always be around.

Your children are not your retirement plan and there is no

loan for the retirement goal as opposed to home loan and education loan.

According to a study by Max Insurance, 80% of urban Indians

are not ready for retirement.

The longer you delay investing towards your retirement plan,

the harder it gets.

.jpg)