A Systematic Investment Plan (SIP) is a popular and

affordable method via which you can invest in mutual funds.

Minor but periodic addition to your mutual fund portfolio

can leave you in awe without much effort from your side.

This approach is also a worthy option in case you wish to

commence your SIP journey small and gradually increase your amount.

Any increase in salary should be accompanied with an

increase in your SIP.

How to

increase your Sips?

You have two options via which you can increase your SIPs,

amount or percentage.

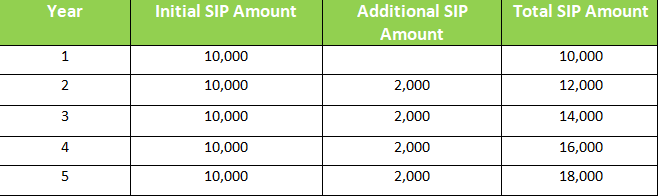

Amount

Under this method you simply increase your sip amount by a

fixed amount each year.

For example, let’s say you start your sip journey with an

amount of 10,000.

You then add an additional fixed 2,000 each passing year.

The table below explains in detail how this would work

assuming an initial sip amount of 10,000 with an additional 2,000 every passing

year.

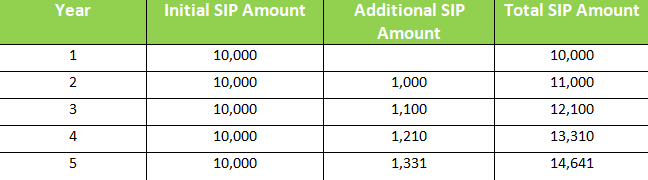

Percentage

Under this method you increase your sip amount by a fixed

percentage each year.

For example, let’s say you start your sip journey with an

amount of 10,000.

You then add an additional 10% of the sip amount each year.

The table below explains in detail how this would work

assuming an initial sip amount of 10,000 with an additional 10% every passing

year.

With regards to which method is better, it totally depends

on what works for you after considering all the available points that can and

should be considered.

Ideally though, the method that is closer to reflecting your

rise in income should be preferred.

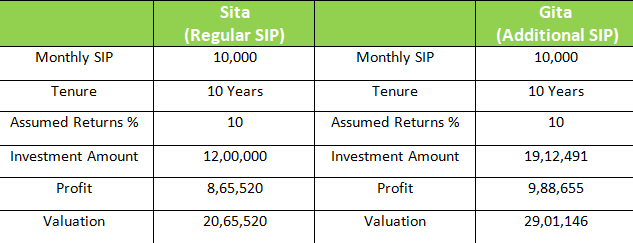

Difference

between Regular & Additional SIPs

The table below illustrates the difference between regular

SIP and when you consistently add to your regular sips.

In the table above we have considered a Step up rate of 10%

for Gita while the SIP contribution for Sita remains constant which is why we

see a difference of 8,35,626 between the

two in terms of the final valuation.

Benefits of

Increasing SIPs

Builds Discipline

It is in the modern human to spend first and save

later, to cater to our comfort prior to saving for our needs.

Let’s say you are allocating 20% of your monthly income

towards sips, any increase in your salary/income should be corroborated by the

same allocation towards sips.

Your sips should reflect the new raise, this makes sure you

are consistent and not laidback in your planning.

Helps beat Inflation

In a developing economy like India, the purchasing power

will not remain the same.

On an average, the inflation rate was more than 6% in the

last decade for India.

This is on the higher side and will continue to rise for

other expenses like education and health.

Adding to your sips annually not only opens the possibility

of beating inflation but also in reaching your goals quicker.

Surplus Corpus

More often than not people find it difficult to start

investing and find it even harder to stay invested.

Now imagine a scenario where not only do you stay invested

but end up accumulating more than your required goal amount.

This is very much a possibility if your portfolio does

better than your initial expectations.

You can never have too much money, how you manage it is a

different ball game though.

Possible

Barriers

No Rise in Income

For this to work, there needs to be a regular rise in income

in a linear manner annually.

If not then this becomes difficult to implement cause

whether income rises or not, your expenses definitely will.

In such scenarios continuing the initial sip that you

started in the first year itself becomes challenging, let alone the additional

ones.

Rise in Expenses

Whether we like it or no, expenses are always on the rise.

India is a developing economy and thereby inflation is a

feature.

On top of that you have lifestyle inflation to cater to.

Life is always surprising us, some expenses can be well

planned but some can only be only well managed. You can always plan to have a

baby but a health emergency can be difficult to foresee.

Step Up Sip

Besides traditional SIPs, there’s something called as Step

Up Sip.

Step Up Sip is an avenue via which your sip amount increases

periodically either via a fixed percentage or amount.

Unlike a traditional SIP you will have to mention the fixed

percentage or amount prior to starting a Step Up Sip and the entire process is

automated.

Step Up Sip gives you the facility to increase your sip

amount at a pre-determined date and thereby not allowing procrastinating to set

in.

Not all AMC’s and portals have this process in place at

present.

While SIPs are a very convenient and affordable manner by

which you can achieve your financial goals, adding to them periodically is the

need of the hour.

Rising expenses, erosion of rupee, multiples life goals,

etc. have all made an addition to your regular sips a nice and comfortable

option to resort to.

It is always better to have it and not need it than to need

it and not have it.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com