Equity investing as a term evokes mixed emotions, mostly sliding on the side of greed and misinformation.

This can be further ascertained by the contribution of

retail investors to the equity markets that is still in single digits.

A major roadblock to a scenario of higher retail participation more than anything is

simple misinformation, far too many folks are either consumed by fear or are in

it for the wrong reasons.

Imagine getting upset at the officials for arranging a

football game at a football stadium when you were all decked up to watch a game

of cricket , sounds silly doesn’t it?

In a similar vein volatility in equity investing should not

deter you, rather one should embrace it like a feature of it, in a manner

similar to a drinks break in a game of cricket.

Audience cheering from the outside does not win a game, the

participants do and so the only way to have any possibility of winning is by

participating in the game.

Why Equity Investing?

Post the LPG reforms of 1991 that opened up the economy,

India has been on an upward trajectory.

This should not be misconstrued as India being immune to

periodic shocks, far from it.

In fact as an economy dependent on foreign sources for its

biggest import bill (oil), India is far more susceptible to outside upheavals

besides the obvious internal instability.

Despite all the various challenges the Indian economy

faces/has faced, equity markets have been on the rise which can be attested by

the growth of Sensex.

This does not imply the absence of downtime but rather is a

testament of the growth of our equity markets despite periods of lull.

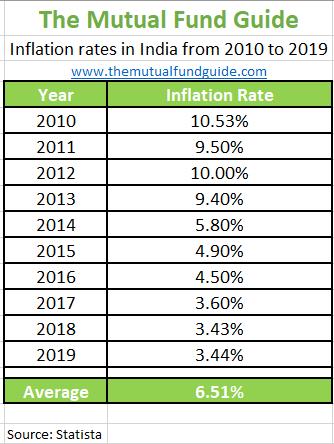

Our growth rate hovers around 6-7% while that of inflation

is either on similar lines or less than that, compare that to the global

average growth of 4% it only proves we are doing better than the global

average.

A major reason for this is the base effect, India still has

catching up to do with the developed countries with respect to major goals such

as education, infrastructure, health, employment, etc.

These are issues no country wanting to be self-sufficient

can ignore for too long, in India’s case this is all the more imperative for

geo-political reasons.

The potential for India to grow is massive despite our

impressive growth in the last 3 decades, we still have a lot of catching up to

do.

As a salaried employee being dependent on your salary to

accumulate wealth isn’t going to result in anything of much significance, a

much better proposition would be to own businesses and what better way to own a

part of a business than via equity investing.

Historically equity markets have mirrored the overall growth

of the economy, if you believe in the unrealized potential of India then there

is no better place than the equity markets to reap the benefits of it.

Value EQ over IQ

It is not the smartest individual that is successful when it

comes to equity investing but rather the more disciplined one.

Emotional Intelligence (EQ) helps avoid taking impulsive

decisions and in prioritizing long term goals over short term desires.

Market movements are rarely linear and usually in either

way, that should be seen as a feature and not a bug.

Your ability to withstand outside noise and your inner greed

will eventually decide your fate as an investor.

History is testament to markets undergoing various periods

of booms and busts and the future shall be no different, rather than fearing

volatility the shrewd investor harnesses the potential of such downturn.

Goal Based Approach

It is imperative that you have a goal based approach to

equity investing.

This is all the more vital when you are investing in a

developing market as opposed to a developed market since volatility will

always be around.

Having a goal based approach would mean you would be less

bothered by the ups and downs and more motivated by reaching your goals.

The pitfalls and roadblocks in the form of volatility, greed

and outside noise can be better managed by such an approach.

Having a goal based approach inculcates discipline and a

long term outlook while also helping in looking at your long term goals thereby

avoiding short term greed.

Avoid Outside Noise

Unfortunately even today it is not uncommon to hear stories

of individuals entering the market at its peak after observing ‘success

stories’ of their friends, relatives, colleagues, etc.

That is an unhealthy motivation, half-baked knowledge and a

very narrow understanding of success.

In a similar vein it is also not surprising to hear stories

of those exiting the market at the hint of a slight correction or cause they’ve

been recommended to do so by someone who’s not a professional advisor.

The issue with such cases is not just the financial loss but

also the experience attached, anyone who has entered the market at its zenith

and exited at a loss will be haunted for a long time, maybe forever thus even

deciding to never invest in equity markets again.

It does not help that we are living during times of

fanaticism, every jump and correction is dissected and presented as the next

oil rig or the never ending dig to a bottom that may never be reached.

Have a goal, make a plan for it, review it periodically and

stick with it only until and unless you have rational and logical reasons for

the same, the only outside noise should be of a qualified and certified

professional managing your investments.

Investing in the Equity market is not about entry and exit

but rather your ability to stay put even when staying put seems like a farcical

spoof.

You do not need a large sum to enter or stay in the equity

market, in fact there are several mediums and amounts via which you can invest and the most popular of them being the SIP

mode.

Irrespective of whether you can/do invest via lumpsum

investments or not, it is always better to have running SIP’s since they can

counter volatility and help with compounding.

Keep increasing your SIP’s on an annual basis, this will

help in countering inflation and help in reaching your goal faster.

During present times, almost all processes for investing can

be done online without the need for offline documentation.

The real benefits of equity investing can only be realized

in the long run, money is made but wealth is created and any creation takes

time.

Stay invested in the equity market and give your money an

opportunity to compound into wealth.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com