Mirae Asset Emerging Bluechip Fund

Fund Manager: Mr Neelesh Surana & Mr Ankit

Jain

Category: Large&Mid Cap

Date of Inception: 09th July 2009

Benchmark: S&P BSE 200 India TR INR

The objective of Mirae Asset Emerging Bluechip is to

pick companies today that have the potential to become the bluechips of

tomorrow.

The Fund by mandate needs to invest a minimum of 35% each into both

large and mid cap stocks.

The remaining 30% is at the discretion of the fund

manager so the fund manager can invest as and where he wishes to.

* Mirae Asset Emerging Bluechip Fund has discontinued fresh lumpsum subscription with effect from 25/10/2016

Mirae Asset Emerging

Bluechip Fund Investment Philosophy

It is important to understand how and why Mirae Asset Emerging Bluechip Fund picks a company, the process of it and a detailed explanation of the same is given below.

For portfolio enquiries, email us with your doubts at info@themutualfundguide.com

Management

- A company that records profits for a year does not by default become a good company.

- The profits have to be studied in relation to the costs involved and the margins necessary for it to have a sustainable future.

- Let’s say that a company is under severe debt and records a profitable year. Instead of clearing off its debt it decides to go for more expansion thereby taking on stress it could have otherwise postponed.

- Another way to look at it is to use the current profit to pay off as much debt as possible and get the company on a strong foothold.

- It is the way you manage that makes all the difference, which is why having a robust management team in place plays a strong role.

Great companies are not built on excel sheets, they are built by efficient people.

Although leadership qualities cannot be quantified, a good

corporate governance track record helps

Good Companies survive on valuations whereas great companies thrive on them

Business Selection

Certain businesses are cyclical in nature, meaning they tend

to be more volatile than the others. Mirae Asset Emerging Bluechip sticks to picking companies that have a

sustainable future since the idea is to buy and hold and not buy and sell.

The High ROI (Returns on Investment) factor means it stays away from companies that do not have good projections for high earnings and growth.

Being the leader in a particular sector is not a

strong enough reason to invest, the advantage has to be fruitful enough and

risk worthy venturing into.

Valuation

Price is what you pay, value is what you get.

- Certain companies may seem undervalued while others may seem overvalued. This cannot be studied in isolation though.

- At times a certain undervalued stock may seem like a great prospect but you also would need to figure out why exactly is it down. Irrespective of undervalued or overvalued, strong fundamentals eventually make the real difference.

- A stock may be down since the entire sector is down or due to adverse news, with the latter there arises a great buying opportunity given the fundamentals of the company is robust.

- The idea is to pick stocks that provide value for price.

Valuations as previously mentioned cannot be studied in isolation and have to

be studied along with considering the underlying risks.

Mirae Asset Emerging Bluechip Fund Portfolio

Mirae Asset Emerging Bluechip Fund was never a Pure Mid Cap Fund to begin with, a Pure Mid Cap should allocate a minimum of 3/4th of its investments into mid cap stocks.

SEBI’s re-categorization of schemes only began in 2018,

earlier allocation to equity schemes had no fixed mandate as such.

The portfolio was heavy on sectors based on market conditions

with no bias for one particular sector or category. So if the mid-caps were

seen to be overvalued then the large cap portion would become heavy..

This was often its go to approach which would be of extreme

help in times of a market downturn since large cap stocks tend to be more

stable and less volatile as compared to mid-cap stocks.

This was also the reason for its high portfolio turnover

ratio.

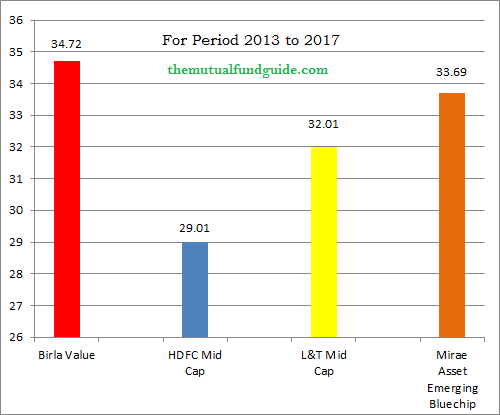

Only Birla Pure Value Fund beats it over the last 5 years

whereas Mirae Asset Emerging Bluechip Fund beats HDFC midcap fund impressively and L&T Mid Cap slightly.

Click Here to read our complete review of HDFC Midcap Opportunities Fund.

- Mirae Asset Emerging Bluechip Fund was actively managed in the past keeping in mind valuations with respect to market conditions. This helped it beat other mid cap mutual fund schemes except for Birla Pure Value Fund, this is because of its entry and exit approach rather than an entry and hold approach.

- The major credit for this has to be given to the Fund Manager since it was actively managed. If you are wondering why the Birla Pure Value Fund surpasses it, it is because the Birla Pure Value Fund has an inherent approach of value investing.

- Although the returns are impressive, it goes through periods of extreme highs and lows and has a standard deviation that is at a level much higher than other categories.

Click Here to find a detailed review on Aditya Birla Pure Value Fund

Mirae Asset Emerging Bluechip Fund generally held between 60 to 75

stocks based on the philosophy explained at the beginning which therefore means

it was selective and heavily filtered.

How SEBI’s re-categorization of schemes affects Mirae

Asset Emerging Bluechip Fund?

The following is by no

means a prediction of future returns

Past scenario

As previously mentioned, Mirae Asset Emerging Bluechip was

categorized as a Mid-Cap Fund but was a predominantly Large & Mid-Cap Fund and never a

Pure Mid Cap Fund as such. This gave the Fund Manager a freehand at Large Cap

Stocks when the mid cap sector seemed overvalued and thereby worked as a buffer

against market volatility.

After SEBI categorization it is now a Large & Mid Cap

Fund. This requires it to invest a minimum of 35% each into Large & Mid cap

stocks with the remaining 30% at the discretion of the Fund Manager.

These changes will have an impact because the investment of

35% into large cap stocks now is ‘’Mandatory’’ and not at the discretion of the Fund Manager.

The 30% allocation which is at the discretion will in many ways play an important role in the difference between various Large & Mid Cap schemes, it is possible for various schemes within the same category to have varying levels of returns and deviations.

Present scenario

In the first half of 2018, only 4 large cap schemes managed

to give positive returns whereas the benchmark S&P BSE 100 India TRI gave

returns of 0.34%. All other schemes in the Large Cap category gave negative

returns to the tune of 3-7%.

The only 4 large cap schemes to give positive

returns were:

Axis Bluechip Fund

Edelweiss Large Cap Fund

Invesco India Large

Cap Fund and

Canara Robeco Large Cap Equity.

Even though Sensex touched 36,000, it was primarily driven

by a couple of stocks who themselves were driven by strong Q3 earnings. Some of

these stocks like Reliance Industries and Infosys also formed a major chunk of

Axis Bluechip Fund.

Click Here to read more on why Axis Mutual Fund Schemes did so well in 2018

After SEBI re-categorizing what constitutes a Large Cap

Stock and the minimum allocation mandated in schemes accordingly, it becomes

all the more important to filter fundamentally robust stocks with a strong earnings

outlook. Only the top 100 stocks in terms of market cap are now defined as

Large Cap Stocks so therefore one is restricted when it comes to stock

pickings.

Mirae Asset Emerging Bluechip Fund is a Large & Mid Cap Fund

so therefore it needs a mandated 35% investments into large cap stocks but as

2018 has proven, SEBI’s re-categorization of Large Cap stocks makes the Fund

Manager’s choices limited.

This is because he/she would have to be selective in an already

diminished Large Cap universe. Secondly Large caps previously served has a good

buffer against market volatility but this is no more the case. Even when Sensex

touched 36,000, individual stock prices were down.

You would also have to keep in mind that just like Mirae

Asset Emerging Bluechip was never a true Mid Cap Fund, most other so

called Large Cap Funds were also never a true Large Cap Fund so to speak. A classic

example of this is the Invesco Growth Opportunities Fund (now a Large & Mid Cap Fund) which was previously a Large Cap Fund.

It would at times hold position in

mid & small cap stocks up to 49% of the entire portfolio. This was a very

common practice among Fund Managers to drive up the alpha but that cannot be

the case anymore.

SEBI’s re-categorization exercise of 2018 has made past

returns as an important factor in deciding to invest or not, a redundant point.

As it is, past returns should never be the sole criteria when deciding on a

scheme but unfortunately a major chunk of the investor community is still

adamant on the same.

SEBI’s re-categorization exercise was directed towards a

more refined and well defined structure of schemes which would make it easier for you to know where you are investing and what should be your expectations.

The regulator has done its role, have you?

Got some questions ? We've got the answers,

email us at info@themutualfundguide.com

Disclaimer : While due precaution has been undertaken in the preparation of this article, The Mutual Fund Guide or any of its authors will not be held liable for any investments based on the above article. The above article should not be considered financial advice and has been published only for your perusal. Due credit has been given in case wherever required, in case you feel any part violates any rights then do get in touch with us and we shall get it duly removed.

Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing

Copyright © 2019 The Mutual Fund Guide, All rights reserved.